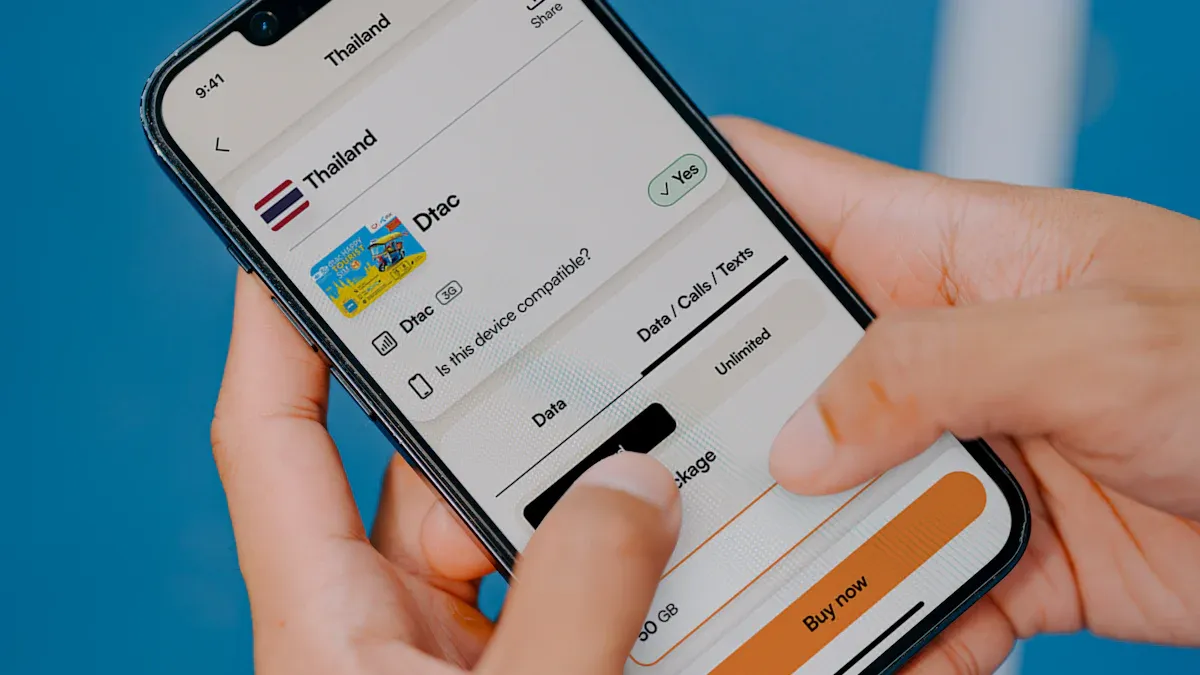

Does Zelle Support International Transactions? A Comprehensive Guide to Alternatives for Cross-Border Remittances

Image Source: unsplash

Key Tip: Zelle does not support international transactions.

It is a transfer service designed exclusively for users within the United States; you must have a U.S. bank account and a U.S. mobile number to register. Although Zelle is extremely popular in the U.S., with 151 million registered users in 2024 processing over $1 trillion in transactions, its functionality is strictly limited to the U.S. mainland. Therefore, you need to find reliable cross-border remittance alternatives. This guide will introduce you to several excellent cross-border remittance alternatives in detail to help you complete transfers easily.

Key Points

- Zelle is only used within the United States and does not support international transfers.

- You need a U.S. bank account and a U.S. mobile number to use Zelle.

- PayPal, Wise, and WorldRemit are commonly used international remittance tools.

- Wise offers real exchange rates with transparent fees, suitable for users seeking low costs.

- When choosing a remittance tool, you should consider fees, speed, and receipt methods.

Zelle’s Limitations: Why It Cannot Go Cross-Border

The reason Zelle cannot be used for international transfers lies at the core of its service design. From its inception, it has been strictly limited to use within the United States. You will find that the following four key restrictions collectively form the insurmountable national boundaries for Zelle.

Hard Requirement: U.S. Bank Account

This is the most fundamental threshold. You must have a bank account located in the United States to register and use Zelle. Whether you are the sender or the recipient, your funds must flow through the U.S. banking system. If your family or friends do not have a U.S. bank account, they will not be able to receive your funds via Zelle.

Registration Threshold: U.S. Local Mobile Number

Zelle’s registration process also locks users into the United States. During registration, you must provide a long-term U.S. mobile number.

Registration Requirement Tip Zelle has very specific requirements for mobile numbers; you need to pay attention:

- It must be a permanent U.S. mobile number held by you personally.

- Landlines, international numbers, or toll-free numbers are not allowed.

- VoIP internet phone numbers (such as Google Voice) also do not meet registration conditions.

Once you register with a U.S. mobile number, the Zelle logo will appear in your profile, making it easy for other U.S. users to identify and transfer money to you. This design completely disregards the needs of international users.

Functional Absence: No Currency Exchange or International Compliance

Zelle is designed for a single currency (USD). It does not have built-in currency exchange functionality nor has it established a compliance system to handle international financial regulations (such as anti-money laundering AML). International remittances involve complex exchange rate calculations and cross-border regulations, and Zelle has not built this infrastructure. This is the core reason you need to seek professional cross-border remittance alternatives.

Payment Restrictions: No Credit Card Payments

Zelle transactions are essentially direct debit transfers between bank accounts. Therefore, you cannot use a credit card as a funding source for Zelle. This further limits payment flexibility, whereas many international remittance services support credit card payments, providing you with more options.

Zelle’s Cross-Border Remittance Alternatives

Image Source: unsplash

Since Zelle cannot handle international transfers, you need a reliable alternative. Fortunately, there are many excellent cross-border remittance services available on the market. These platforms are designed specifically for international transactions, offering currency exchange and diverse payment and receipt methods. Below, we will introduce several mainstream cross-border remittance alternatives to help you find the one that best suits you.

PayPal: Globally Universal Option

PayPal is one of the world’s most well-known online payment platforms, almost universally recognized. Its greatest advantage is its extremely high adoption rate, supporting settlement in multiple currencies worldwide.

- Core Advantages:

- Huge User Base: Your recipient is very likely to already have a PayPal account, making transfers simple.

- Supports Mainland China Bank Cards: You can link your PayPal account with certain bank cards from mainland China for convenient fund management. Based on user feedback, the following banks can usually be successfully linked:

- Industrial and Commercial Bank of China (ICBC)

- Bank of China

- China Merchant’s Bank

- China Construction Bank

- Potential Drawbacks:

Fee Reminder: Watch for Hidden Costs PayPal’s convenience comes with higher fees. When initiating an international transfer from the U.S., you need to note the following costs:

- Transaction Fee: Transferring using PayPal balance or bank account incurs a 5% transaction fee, capped at $4.99.

- Payment Method Surcharge: If using a credit or debit card, in addition to the transaction fee, a 2.90% surcharge and a fixed fee apply.

- Exchange Rate Markup: This is the largest hidden cost. PayPal adds a 3% to 4% markup on top of the market exchange rate. This means for every $1,000 remitted, you may lose $30 to $40 due to the exchange rate.

Wise: Low Cost and Transparent Exchange Rates

Wise (formerly TransferWise) stands out in the cross-border remittance market with its core philosophy of “transparency” and “low cost.” It is particularly suitable for users seeking high value for money.

- Core Advantages:

- Real Mid-Market Exchange Rate: Wise’s biggest highlight is that it uses the real mid-market rate—the same rate you see on Google. Traditional banks usually add hidden markups to this rate, while Wise is completely transparent, eliminating this hidden charge.

- Clear Fees: Wise only charges a low, transparent service fee; you can clearly see all fees and the final amount received before transferring.

- Potential Drawbacks:

- Limited Receipt Methods: Wise primarily supports bank-to-bank transfers. If your recipient needs to withdraw cash immediately, Wise may not be the most convenient choice.

- Large Transfer Limits: Some countries/regions have limits on single transfer amounts; you need to confirm before proceeding.

WorldRemit: Flexible Receipt Methods

If you want your recipient to get the money in the most convenient way, WorldRemit is an excellent choice. It offers extremely diverse receipt options.

- Core Advantages:

- Diverse Receipt Methods: In addition to standard bank transfers, WorldRemit supports cash pickup, mobile wallet top-ups, and debit/credit card receipts. For example, when remitting to the Philippines, recipients can receive funds via:

- Bank deposit

- Cash pickup

- Mobile wallet (such as GCash, GrabPay, Maya)

- Fast Arrival: Many transactions, especially cash pickups and mobile wallet top-ups, can be completed almost instantly.

- Diverse Receipt Methods: In addition to standard bank transfers, WorldRemit supports cash pickup, mobile wallet top-ups, and debit/credit card receipts. For example, when remitting to the Philippines, recipients can receive funds via:

- Potential Drawbacks:

- Variable Fees and Rates: Fees and exchange rates vary depending on the destination, payment method, and receipt method; you need to compare carefully to determine the final cost.

Remitly: Many New User Promotions

Remitly focuses on providing remittance services for immigrants and their families, known for its attractive new user promotions and flexible transfer speed options.

- Core Advantages:

- Exclusive New User Offers: Remitly often provides fee waivers or better exchange rates for first-time customers. This is a great “try-it-out” opportunity, but note that these offers are usually limited to the first transfer.

- Two Transfer Modes: You can choose between speed and cost based on your needs.

| Service Type | Speed | Fees and Exchange Rate |

|---|---|---|

| Economy | 3-5 business days | Lower fees, better exchange rate |

| Express | Usually within minutes | Same fees, but higher exchange rate markup |

- Potential Drawbacks:

- Exchange Rate Markup: Even for Economy service, Remitly’s exchange rate includes a 0.4% to 1.4% markup. Choosing Express means paying a higher exchange rate cost for speed.

Western Union: Extensive Offline Network

Western Union is one of the oldest remittance companies, with its greatest advantage being its unparalleled global network of offline agents.

- Core Advantages:

- Global Coverage: Western Union has hundreds of thousands of agent locations worldwide. For example, in India alone, there are over 111,000 locations. This means even if your recipient has no bank account, they can easily pick up cash at a nearby agent.

- Brand Reputation: As a century-old brand, Western Union enjoys a strong reputation for reliability and security.

- Potential Drawbacks:

- Higher Fees: To maintain its vast offline network, Western Union’s transfer fees and exchange rate markups are usually higher than pure online services. Convenience comes at a price.

MoneyGram: Traditional Reliable Choice

MoneyGram, like Western Union, is a traditional remittance provider with an extensive offline network, offering reliable cash pickup services.

- Core Advantages:

- Online and Offline Integration: You can initiate online transfers via its website or app or visit a physical store. Online transfers have lower operating costs, so fees are usually cheaper than in-store.

- Fast Cash Pickup: Whether initiated online or in-store, as long as cash pickup is chosen, funds are usually ready within minutes.

- Potential Drawbacks:

- Higher Costs: Like Western Union, its fees and exchange rate competitiveness are generally lower than emerging digital platforms like Wise.

- Slower Bank Deposits: If remitting to a bank account, it may take several business days to arrive.

Choosing the right cross-border remittance alternative can save you a significant amount of time and money.

How to Choose the Best Remittance Tool

Image Source: unsplash

Faced with numerous options, you may feel confused. To help you make an informed decision, we first provide a clear table for a side-by-side comparison of key metrics for Zelle and the major cross-border remittance alternatives.

Key Metrics Side-by-Side Comparison

The table below summarizes the core differences in fees, speed, and features across services.

| Service | Fee Structure | Transfer Speed | Supported Countries/Regions | Payment Methods | Receipt Methods |

|---|---|---|---|---|---|

| Zelle | Free | Within minutes | U.S. only | Bank account | Bank account |

| PayPal | Transaction fee + 3-4% exchange rate markup | Within minutes | Most countries globally | Bank account, credit card, balance | PayPal account |

| Wise | Low service fee, no exchange rate markup | 1-2 business days | Over 80 countries, including China | Bank account, credit card | Bank account |

| WorldRemit | Service fee + exchange rate markup | Minutes to several days | Over 140 countries | Bank account, credit card | Bank account, cash pickup, mobile wallet |

| Remitly | Service fee + exchange rate markup | Minutes to several days | Over 100 countries | Bank account, credit card | Bank account, cash pickup, mobile wallet |

| Western Union | Higher service fee + exchange rate markup | Minutes (cash) | Over 200 countries | Bank account, credit card, in-person | Cash pickup, bank account |

| MoneyGram | Service fee + exchange rate markup | Minutes (cash) | Over 200 countries | Bank account, credit card, in-person | Cash pickup, bank account |

Important Note The transfer speeds and fees in the table are for general reference only. Actual costs and arrival times vary depending on the destination, payment method, and remittance amount. For example, international bank transfers typically take 1-5 business days.

Choose Based on Core Needs

Now, you can select the most suitable platform from these excellent options based on your specific needs.

- If You Seek the Lowest Cost 💰

Recommendation: Wise Wise is your best choice. It always uses the real mid-market exchange rate, eliminating the largest hidden cost of exchange rate markups. You only pay a small, transparent service fee, making it ideal for price-sensitive users.

- If You Need Fast Cash Receipt 🏃

Recommendation: WorldRemit, Western Union, or Remitly When your recipient urgently needs cash or lives in an area with limited banking services, these three providers stand out. They have extensive offline networks and diverse receipt methods, including cash pickup and mobile wallets, with many transactions completing in minutes.

- If You Are a Freelancer or Conduct Small Multi-Currency Transactions 🌐

Recommendation: PayPal or Wise PayPal’s global adoption makes it a convenient tool for receiving payments from international clients. For freelancers managing multiple currencies, Wise’s multi-currency account is also an excellent choice, supporting receipt in over 50 currencies with extremely low conversion fees.

In summary, Zelle is an excellent tool for transfers within the U.S., but for international remittances, you need to look elsewhere. The various solutions introduced in this article each have their strengths, from low-cost Wise to widely networked Western Union, all providing reliable options.

After shortlisting the usual providers, some readers may prefer to keep rate checks → conversion → payment → tracking in one place to reduce friction and hidden FX slippage. BiyaPay is a multi-asset trading wallet that lets you handle pricing, route comparison, and the actual cross-border transfer within one domain:

- Start with the Exchange Rate Converter to see real-time rates and all-in costs;

- Create a watchlist and beneficiaries via quick Account Registration;

- When ready, initiate an international transfer through Remittance with transparent fees and trackable status.

For assurance, BiyaPay operates under recognized supervision in multiple regions (e.g., U.S. MSB and New Zealand FSP). To make the evaluation explicit, BiyaPay keeps these product traits front and center: support for free conversion between multiple fiat currencies and digital currencies; real-time and transparent display of exchange rates; handling fees as low as 0.5%; same-day remittance and same-day arrival; support for most countries and regions around the world.。

If you like to test with a small amount first, periodic offers in the Events Center can further compress marginal costs. This complements the article’s neutral comparison—it simply adds an option for readers who prefer a single, end-to-end flow.

Key Points There is no absolute “best choice,” only the solution that best fits your personal needs. Digital remittances are rapidly becoming mainstream due to their speed and low cost.

We hope you can use the comparison information in this article, combined with your considerations of fees, speed, and convenience, to make an informed decision and easily complete your next cross-border remittance.

FAQ

Can I use Zelle to send money to my family in mainland China?

No. Zelle requires the recipient to also have a U.S. bank account. Since your family in mainland China does not have a U.S. account, they cannot receive your funds via Zelle. You need to choose one of the international remittance alternatives introduced in this article.

Can friends abroad use Zelle to send money to me?

No. Zelle is a purely U.S.-based transfer system. If your friends are not in the U.S., they cannot register or use Zelle. They need to use international remittance services like Wise or PayPal to send funds to your U.S. bank account.

Are these Zelle alternatives safe?

Yes, these platforms are safe. Companies like Wise, PayPal, and Western Union are regulated financial service institutions. They employ encryption and other security measures to protect your funds and personal information, so you can use them with confidence.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Understand the Core Differences Between the Nasdaq Composite Index and Nasdaq 100 Index in One Article

Say Goodbye to Bank Queues: Latest 2025 Bank of China App Guide for Converting Cash to Exchange

After Over 100 Billion in Buybacks, Has Tencent's Long-Term Investment Logic Changed?

2025 Taiwan Stock Market Year-End Review and 2026 Outlook: Can the AI Boom Continue?

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.