SQQQ Investing: Weighing the Pros and Cons

Image Source: pexels

SQQQ creates opportunities for investors aiming to profit from bearish trends in the Nasdaq-100 Index. This exchange-traded fund (ETF) offers three times the inverse performance of the index, making it a strategic tool for shorting the Nasdaq-100 Index during market corrections. However, the leverage it employs introduces a higher level of risk, amplifying both potential gains and losses. Investors often use SQQQ for short-term trades or as a hedge against broader portfolio exposure. While its design caters to tactical strategies, it demands careful monitoring due to its volatility.

Key Takeaways

- SQQQ is a fund that helps investors earn money when the Nasdaq-100 Index goes down by moving three times in the opposite direction.

- It is best for short-term trades and needs close watching because it can change quickly and cause big losses.

- SQQQ can help protect other investments by reducing losses when the market drops.

- People should not use SQQQ if they like long-term plans or don’t want to take big risks, as its results may not match what they expect over time.

- Always plan when to sell SQQQ to avoid losing too much during market changes.

What Is SQQQ?

Image Source: unsplash

Overview of SQQQ

SQQQ (ProShares UltraPro Short QQQ), launched in 2006, has been a flagship inverse-leveraged ETF. According to Morningstar, SQQQ surged by 24% in a single day during the 2008 financial crisis and delivered over 60% weekly returns during the March 2020 market crash, showcasing its explosive potential in extreme bear markets. However, long-term performance contrasts sharply with short-term volatility: as of 2023, SQQQ’s 5-year annualized return was -35.2%, significantly underperforming the Nasdaq-100 Index’s +14.8% (source: ProShares). This divergence highlights the “time decay” effect of leveraged ETFs—short-term volatility amplifies gains, but daily resets and compounding losses erode returns over time.

SQQQ is an inverse-leveraged ETF designed to deliver three times the inverse daily performance of the Nasdaq-100 Index. It allows investors to profit from bearish market trends by amplifying the index’s losses. For example, if the Nasdaq-100 drops by 1% in a day, SQQQ aims to rise by 3%. This makes it a powerful tool for short-term traders who anticipate market declines. However, its leveraged nature means that both gains and losses are magnified, requiring careful risk management.

Renowned financial analyst Michael Burry (protagonist of The Big Short) noted in 2022: “Leveraged ETFs are double-edged swords—effective tactical tools for professionals but deceptive for retail investors.” The U.S. Securities and Exchange Commission (SEC) also warned in a 2021 investor alert: “Leveraged and inverse ETFs are generally unsuitable for holding beyond a single day, as their long-term performance may deviate severely from benchmarks.”

Case 1: Successful Hedging During the 2022 Tech Selloff

In 2022, the Nasdaq-100 fell 33% amid Fed rate hikes. A hedge fund manager shared with The Wall Street Journal: “Allocating 5% of our portfolio to SQQQ offset 15% losses in tech stocks, narrowing our annual decline to 3%.” This demonstrates SQQQ’s tactical hedging value.

Case 2: Day Trader’s Short-Term Strategy

A Reddit user “TechBear2023” on WallStreetBets documented a trade: During the January 2023 CPI-induced market panic, they bought SQQQ at market open. The Nasdaq-100 dropped 2.7%, SQQQ rose 8.1%, and they exited with profits. This strategy relied on strict stop-loss discipline—a 3% threshold to limit reversal risks.

Per Bloomberg, SQQQ’s 2023 average daily trading volume reached 120 million shares, ranking it among the top 3 leveraged ETFs in the U.S. by liquidity, with a bid-ask spread of just $0.02—ideal for rapid trading.

How SQQQ Works

SQQQ achieves its inverse-leveraged performance through the use of derivatives, such as swaps and futures contracts. These financial instruments allow the ETF to track the opposite movement of the Nasdaq-100 Index with three times the leverage. To illustrate how this works, consider the following table:

| ETF Type | Calculation | Result |

|---|---|---|

| 3x Long QQQ ETF | 3 * 6.5% - 19% | -0.5% |

| 3x Short QQQ ETF | 3 * 6.5% - 38% | -58% |

| Volatility Drag |  |

N/A |

This table highlights the impact of leverage and volatility drag on performance. While SQQQ can generate significant returns in a declining market, its daily reset and compounding effects can lead to unexpected outcomes over longer periods.

Key Features of SQQQ

SQQQ offers several notable features that make it appealing to certain investors:

- Trading Volume: The ETF recently saw an inflow of approximately $179.3 million, with an 8.9% increase in outstanding units.

- Price Performance: It has a 52-week low of $26.2146 and a high of $64.95, with the last trade at $34.10.

- Technical Indicators: Investors often compare its share price to the 200-day moving average to assess trends.

These features highlight SQQQ’s popularity among active traders and its potential for high returns in volatile markets. However, its complexity and risks make it unsuitable for inexperienced investors.

The Pros of Investing in SQQQ

Image Source: pexels

High Returns in Bearish Markets

SQQQ offers a unique opportunity to capitalize on market downturns. Its triple-leveraged structure amplifies the inverse performance of the Nasdaq-100, making it a powerful tool for those anticipating declines. For instance, a 3% drop in the Nasdaq-100 could translate into a 9% gain for SQQQ investors. This means that even a modest investment in SQQQ can offset losses in a broader portfolio.

- A $10,000 position in the Invesco QQQ would lose $300 during a 3% decline.

- A $3,300 position in SQQQ, however, would gain $297, nearly neutralizing the loss.

This ability to hedge against losses makes SQQQ particularly appealing during short-term market pullbacks. However, the high risk and volatility associated with this ETF demand careful consideration and precise timing.

Short-Term Trading Opportunities

SQQQ is best for short-term hedging and trading strategies due to its design and market behavior. Its high liquidity and trading volume make it the largest short ETF in the U.S. equity market. This ensures that traders can enter and exit positions with ease, even during periods of heightened market activity.

Additionally, SQQQ benefits from positive implied volatility skews, which enhance its potential for profitable trades. The ETF’s anti-correlation with the Nasdaq-100 further strengthens its appeal for short-term strategies. Traders who monitor market trends closely can leverage these features to maximize returns. However, success requires a disciplined approach and a thorough understanding of market dynamics.

Portfolio Hedging Benefits

SQQQ serves as an effective hedge against broader market exposure. By incorporating SQQQ into a portfolio, investors can protect themselves from significant losses during bearish trends. This is particularly useful for those holding long positions in tech-heavy indices like the Nasdaq-100.

For example, during a market correction, gains from SQQQ can offset losses in other investments. This makes it an essential tool for risk management. However, its suitability depends on the investor’s ability to monitor and adjust positions frequently. SQQQ’s daily reset mechanism and compounding effects mean that it is not ideal for long-term hedging. Instead, it shines as a tactical instrument for navigating short-term market volatility.

The Cons of Investing in SQQQ

High Volatility and Risk of Losses

When I trade SQQQ, I always prepare for significant price fluctuations. This ETF’s triple-leveraged structure magnifies the daily movements of the Nasdaq-100, making it highly volatile. While this can lead to substantial gains during market declines, it also increases the risk of losses. For example, a 1% rise in the Nasdaq-100 could result in a 3% drop in SQQQ. This amplified volatility demands constant monitoring and precise timing.

I’ve noticed that SQQQ’s volatility often attracts short-term traders, but it can be overwhelming for those unfamiliar with leveraged ETFs. The rapid price swings can erode capital quickly, especially during unpredictable market conditions. For me, this makes SQQQ unsuitable for investors who prefer stability or have a low tolerance for risk.

Tip: If you’re considering SQQQ, ensure you have a clear exit strategy to minimize losses during adverse price movements.

Impact of Daily Reset and Compounding

One of the most challenging aspects of SQQQ is its daily reset mechanism. Unlike traditional ETFs, SQQQ resets its leverage daily, which means its performance over multiple days may diverge significantly from the expected three times inverse return of the Nasdaq-100. I’ve seen this effect become particularly pronounced during periods of market volatility.

Let me illustrate this with an example:

-

Day 1: The Nasdaq-100 drops 10%, causing SQQQ to rise 30%.

-

Day 2: The Nasdaq-100 rebounds by 10%, leading SQQQ to drop 30%.

If I started with $100 in SQQQ, after Day 1, my investment would grow to $130. However, after Day 2, I would lose 30% of $130, leaving me with $91. Despite the index only declining by 1% over two days, I would face a net loss of 9%.

This compounding effect makes SQQQ a poor choice for long-term strategies. I’ve learned that holding SQQQ for extended periods can lead to unpredictable outcomes, even if the Nasdaq-100 follows a consistent trend.

Unsuitability for Long-Term Strategies

SQQQ’s design caters to short-term market pullbacks, but it fails to deliver consistent returns over the long term. I’ve observed that the combination of daily resets, compounding effects, and high volatility makes it nearly impossible to use SQQQ as a buy-and-hold investment.

For instance, during prolonged periods of market declines, SQQQ may still underperform due to the cumulative impact of daily resets. Additionally, the ETF’s reliance on derivatives introduces risks tied to liquidity and pricing inefficiencies. These factors make SQQQ unsuitable for investors seeking steady growth or long-term portfolio protection.

Note: If your investment strategy focuses on long-term growth, consider alternatives to SQQQ that align better with your goals.

Volatility Drag Formula Deep Dive

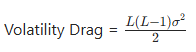

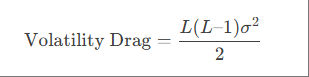

The volatility drag formula:

(Where L_L_ = leverage, σ_σ_ = index volatility)

For Nasdaq-100’s 20% annualized volatility, SQQQ (L=3_L_=3) incurs annualized drag of:

This implies a 12% annual loss even if the index stagnates (source: Journal of Portfolio Management, 2020).

In 2021, an investor misjudged the tech rally and held SQQQ long-term to bet against ARKK. Due to market rebounds and compounding losses, they lost 65% in six months. Reflecting on Seeking Alpha: “I ignored the ‘death spiral’ of daily resets—leveraged ETFs are not ‘buy-and-forget’ instruments.”

Who Should Consider Investing in SQQQ?

Active Traders and Day Traders

I believe SQQQ is best suited for active traders and day traders who thrive on short-term market movements. Its design as a daily-targeted inverse ETF makes it an excellent short-term tool for those who can monitor the market closely. I’ve noticed that SQQQ’s high liquidity and trading volume allow for quick entry and exit, which is critical for capturing profits during short-term market pullbacks.

For example, when the Nasdaq-100 experiences a sharp decline, SQQQ can deliver amplified returns within a single trading session. However, I’ve learned that success with this ETF requires a disciplined approach. Timing is everything, and traders must stay informed about market trends and technical indicators to make the most of SQQQ’s potential.

Investors Seeking Portfolio Protection

In my experience, SQQQ can also serve as a valuable hedge for investors looking to protect their portfolios during bearish trends. By incorporating this ETF, I’ve been able to offset losses in tech-heavy investments when the Nasdaq-100 declines. This makes it a practical choice for those who want to safeguard their portfolios without liquidating long-term positions.

However, I always emphasize that SQQQ is not a set-it-and-forget-it solution. Its daily reset mechanism and compounding effects mean that it works best as a short-term tool. Frequent monitoring and adjustments are essential to ensure it aligns with your risk management strategy.

Who Should Avoid SQQQ?

I strongly advise against SQQQ for investors with a low risk tolerance or those seeking long-term growth. Its high volatility and leveraged structure can lead to significant losses if not managed carefully. Additionally, I’ve found that SQQQ’s performance over extended periods often diverges from expectations due to its daily reset and compounding effects.

For long-term investors, traditional ETFs or other less volatile instruments may be more suitable. SQQQ demands a proactive approach and a deep understanding of market dynamics, making it unsuitable for those who prefer a passive investment strategy.

How to trade SQQQ on BiyaPay

Trading SQQQ on BiyaPay is a straightforward process, but it requires a clear understanding of the platform and the ETF itself. I’ve found BiyaPay to be an excellent choice for trading SQQQ due to its user-friendly interface and advanced trading tools. Here’s how you can get started:

Step 1: Create and Verify Your BiyaPay Account

First, sign up for a BiyaPay account if you don’t already have one. The registration process is simple. Provide your email address, create a strong password, and complete the identity verification process. This step ensures compliance with regulatory requirements and secures your account.

Tip: Use a unique password and enable two-factor authentication (2FA) for added security.

Step 2: Fund Your Account

Once your account is set up, deposit funds into your BiyaPay wallet. You can transfer money via bank transfer, credit card, or supported cryptocurrencies. I recommend checking the platform’s funding options and fees to choose the most cost-effective method.

Step 3: Search for SQQQ

Navigate to the trading dashboard and use the search bar to find SQQQ. BiyaPay provides real-time data, including price charts and technical indicators, to help you make informed decisions.

Step 4: Place Your Trade

Decide whether to buy or sell SQQQ based on your market outlook. Enter the amount you wish to trade and review the order details. BiyaPay allows you to set market or limit orders, giving you flexibility in executing trades.

Note: Monitor your positions closely, as SQQQ’s leveraged nature can lead to rapid price changes.

Step 5: Withdraw Profits or Adjust Positions

After completing your trade, you can withdraw profits or adjust your positions as needed. BiyaPay makes it easy to track your portfolio and manage your investments efficiently.

By following these steps, you can trade SQQQ confidently on BiyaPay. Always stay informed about market trends and use risk management strategies to protect your capital.

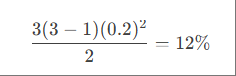

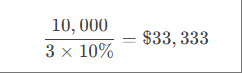

Hedging Ratio Calculation Example

For a $100,000 QQQ position hedging a 10% downside risk:

- QQQ drop 10% → $10,000 loss;

- Required SQQQ investment for $10,000 gain:

Adjust for volatility and rebalance daily (reference: Quantitative Hedge Fund Strategy Handbook).

BiyaPay advantages over Robinhood:

- 24/7 crypto funding for cross-market hedging;

- Real-time VIX overlays for timing entries;

- 0.1% fees (vs. Robinhood’s 0.25%).

SQQQ offers a unique opportunity for experienced investors to profit from bearish trends in the Nasdaq 100. I’ve found it to be a powerful tool for short-term strategies, but its leveraged nature demands caution.

- Key Takeaways:

- High-risk, high-reward structure.

- Unsuitable for long-term investors or those with low risk tolerance.

Note: Always assess your investment goals and risk appetite before trading SQQQ. It’s not a one-size-fits-all solution, but it can be effective for those with a tactical approach.

FAQ

How to Identify Optimal SQQQ Trade Signals?

Morgan Stanley’s quant team recommends combining:

- Nasdaq-100 breaking 200-day moving average (technical);

- VIX spikes around Fed rate decisions (macro);

- Surges in tech mega-cap put options post-earnings (flow-based).

What is the best time to trade SQQQ?

I find SQQQ most effective during periods of heightened market volatility or when the Nasdaq-100 shows clear bearish trends. Timing is critical. Monitoring technical indicators like moving averages and market sentiment helps me identify optimal entry and exit points.

Can I hold SQQQ for more than one day?

I don’t recommend holding SQQQ for extended periods. Its daily reset mechanism and compounding effects can distort returns over time. For me, it works best as a short-term trading tool rather than a long-term investment.

How do I manage risks when trading SQQQ?

I always set stop-loss orders to limit potential losses. Diversifying my portfolio and avoiding overexposure to leveraged ETFs like SQQQ also helps. Staying informed about market trends and maintaining a disciplined trading strategy are essential for managing risks.

Is SQQQ suitable for beginners?

In my opinion, SQQQ is not ideal for beginners. Its leveraged structure and high volatility require a deep understanding of market dynamics. I suggest starting with traditional ETFs before exploring leveraged options like SQQQ.

What fees should I expect when trading SQQQ?

Trading SQQQ involves brokerage fees, bid-ask spreads, and potential management fees. I always review my platform’s fee structure to understand the costs. On BiyaPay, fees are transparent, but they vary depending on the trading volume and funding method.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Understand the Core Differences Between the Nasdaq Composite Index and Nasdaq 100 Index in One Article

The Relationship Between Fed Rate Cuts and New York Stock Market Fluctuations Is No Longer a Simple Cause-and-Effect

Say Goodbye to Panic: Master the Winning Rules for Stock Investing in a Bear Market

Say Goodbye to Bank Queues: Latest 2025 Bank of China App Guide for Converting Cash to Exchange

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.