A must-read for Western Union beginners: How to quickly handle cross-border remittances?

In today’s globalized world, cross-border remittances have become an indispensable part of many people’s lives. Whether it is to support family members studying abroad, support international trade, or deal with emergencies, it is particularly important to find a convenient and efficient way to transfer money. As a company with a history of more than 150 years, Western Union has become a good choice for many people to conduct cross-border transfers with its global service network and flexible operation methods.

Next, we will comprehensively analyze the functions and operations of Western Union remittance for you, helping you easily cope with cross-border remittance needs.

What is Western Union? How does it meet cross-border remittance needs?

Western Union is one of the oldest remittance service companies in the US. It meets cross-border remittance needs in different scenarios by providing global transfer services, virtual wallet recharge, and offline cash withdrawal. Whether you need to transfer funds to a bank account, mobile wallet, or directly withdraw cash, Western Union can flexibly respond.

Compared to other remittance methods, the biggest advantage of Western Union is its wide coverage and diverse operational options. Currently, it covers more than 200 countries and regions worldwide, supports multiple currencies, and has become an important bridge for cross-border fund flows. Especially when quick arrival or emergency needs are needed, Western Union’s offline cash collection service can provide a more direct solution.

A more convenient global multi-asset wallet - BiyaPay

Cross-border remittance can also use BiyaPay, which supports real-time exchange rate inquiry and exchange of more than 30 legal currencies and more than 200 digital currencies, providing a more convenient and efficient solution, mainly with the following advantages:

- Integrated with local transfer methods in most regions, it can achieve zero cost in the intermediate process of bank remittance, and the handling fee is low.

- No limit on remittance amount, more convenient and preferential for large remittances.

- It can achieve instant payment and provide efficient service.

The specific operation process of Western Union remittance

The operation of Western Union remittance is divided into two methods: online and offline. Users can choose the most suitable method according to their own needs.

Online operation :

- Log in to the Western Union official website or app and select the “Send Remittance” function.

- Enter the remittance amount and recipient’s details (such as name, address, account number).

- Provide necessary identity verification materials, such as ID cards or passports.

- After confirming that the information is correct, complete the payment. Supported payment methods include credit cards, debit cards, and bank transfers in some regions.

Offline operation :

- Go to the local Western Union remittance outlet and fill out the remittance form, including the recipient’s information and the remittance amount.

- Present valid identification and complete payment.

- After confirmation, the payee can receive cash through the outlet or directly transfer it to the account.

Regardless of online or offline operations, a remittance tracking number will be generated after the remittance is completed, making it convenient to check the transaction status at any time.

Analysis of limits and fees for Western Union remittances

The limit for Western Union remittances varies by country and currency, but also depends on the bank where the sender is located. The specific limit depends on several factors:

- The originating and receiving countries of remittances

- Bank used by the remitter

- Types of currency used

- User authentication level

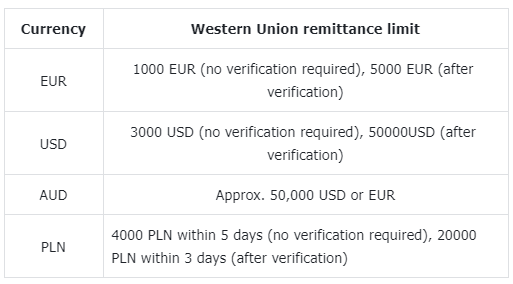

The following table shows the maximum remittance limits for Western Union, covering several common currencies:

Regarding handling fees, Western Union charges a certain fee based on the remittance amount, currency, and payment method. Generally speaking, the fees for choosing bank transfer and credit card payment are relatively high, while the cost of cash payment may be lower. To avoid additional fees, specific charging standards can be confirmed before operation.

Overall, as an established cross-border remittance service provider, Western Union has met the practical needs of many people with its extensive service network, flexible methods, and diverse choices. Whether it is an emergency cash withdrawal or a stable bank transfer, Western Union can provide a suitable solution. Of course, when choosing, it is also necessary to weigh the speed of arrival, fees, and limits according to one’s own needs in order to maximize the value of remittance services.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

2025 Advanced Guide to US Stock Trading: What is Level 2 Data and Software Choices

US Stock Index Futures Trading Secrets: Master the Four Major Indices to Unlock Wealth Opportunities

Master US Stock Trading Hours in One Article: Never Miss Pre-Market and After-Hours Opportunities

US Stock Broker Opening Guide: Fees, Security, and App Experience Comparison (Futu vs Tiger vs Firstrade)

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.