How to Send Money to China from Taiwan? All You Need to Know About Fees, Rates & Delivery Time

Image Source: unsplash

When you need to send money to China, you mainly have two options: traditional bank wire transfers and emerging online remittance platforms. Bank transfers remain dominant, holding over 40% market share, offering the traditional sense of security. However, online platforms are growing at an astonishing pace. They challenge the traditional model with more competitive fees, high efficiency, and user-friendly interfaces, attracting more and more users. Understanding the core differences between the two helps you find the most suitable solution for yourself.

Key Points

- There are two main ways to send money to China: traditional banks and online platforms. Banks are secure; online platforms are fast and transparent with fees.

- When choosing a remittance method, consider handling fees, exchange rates, delivery speed, and remittance limits.

- For small amounts, online platforms usually have lower fees; for large amounts, banks are safer and more reliable.

- China has a $50,000 annual foreign exchange receipt limit per person; confirm this before sending.

- Before remitting, carefully verify recipient details and prepare relevant proof documents to ensure smooth fund delivery.

Remittance Channels: Pros & Cons – Banks vs. Online Platforms

Image Source: unsplash

When choosing a remittance channel, evaluate four key aspects: fees, exchange rates, speed, and limits. Banks and online platforms have different strengths and weaknesses in these areas.

Handling Fees and Cable Charges Comparison

Bank wire transfer fees usually consist of two parts:

- Handling Fee: Calculated as a fixed percentage of the remittance amount, with minimum and maximum charges.

- Cable Charge: A fixed telegraph fee, regardless of the remittance amount.

Online Platform Fee Structure Emerging online platforms mostly use simpler fee structures. They typically charge only a proportional service fee, transparently displayed on the interface so you know the total cost before sending.

Real Exchange Rates and Hidden Costs Explained

The exchange rate is the biggest factor affecting the actual amount received. Banks and online platforms use different rate benchmarks, creating hidden costs.

- Bank Rates: Banks usually add a “markup” to the “mid-market rate” (the rate used between banks), so the posted rate already includes the bank’s profit. This spread is a hidden cost.

- Online Platform Rates: Some platforms (like Wise) use the mid-market rate and charge a separate transparent currency conversion fee. This allows fairer currency exchange and avoids losses from poor rates.

Delivery Speed and Convenience

If you need funds urgently, delivery speed is the top priority.

Traditional bank wires to China generally take 1 to 3 business days, but with multiple intermediary banks or holidays, it may take longer. First-time setups usually require an in-person visit to set up a designated account.

In contrast, online platforms complete the entire process online, unrestricted by bank hours. Many transfers can arrive in the recipient’s account within 24 hours or even minutes, offering extremely high efficiency.

Cross-Strait Annual Remittance Limits

Regardless of the method, you must comply with regulations in Taiwan and China.

- Taiwan Outbound Limits: Taiwanese residents have annual foreign exchange settlement limits; large NTD conversions require Central Bank declaration.

- China Inbound Limits: This is crucial when planning remittances to China. Per China’s State Administration of Foreign Exchange, each Chinese citizen has an annual foreign exchange receipt limit of equivalent to $50,000. Amounts exceeding this require the recipient to provide additional documents to the bank for processing.

Sending Money to China: Major Channels’ Fees and Processes

Image Source: pexels

After understanding the theoretical differences between banks and online platforms, let’s dive into the actual fees and processes of several mainstream channels. This helps you concretely evaluate which option best fits your needs.

Reference Fees for Major Taiwanese Bank Wires

Traditional bank wires are a familiar option for many. Fees mainly consist of a “percentage-based handling fee” and a “fixed cable charge.” For clarity, the table below summarizes overseas remittance charges from three major Taiwanese banks.

Note: The fees below are general standards for in-branch processing; actual charges may vary by account tier or latest bank promotions. Posted rates are not included in the table and are an additional cost to consider.

| Bank | Handling Fee (by Amount) | Cable Charge (per Transfer) | Notes |

|---|---|---|---|

| Bank of Taiwan | 0.05% (min NT$100 / max NT$800) | NT$300 | Full amount to recipient incurs extra fee. |

| E.SUN Bank | 0.05% (min NT$100 / max NT$800) | NT$300 | Online banking offers handling fee discount. |

| Mega Bank | 0.05% (min NT$200 / max NT$800) | NT$300 | One of Taiwan’s main foreign exchange banks. |

As shown, even for small amounts, you’ll pay at least NT$400 to NT$500 in basic fees.

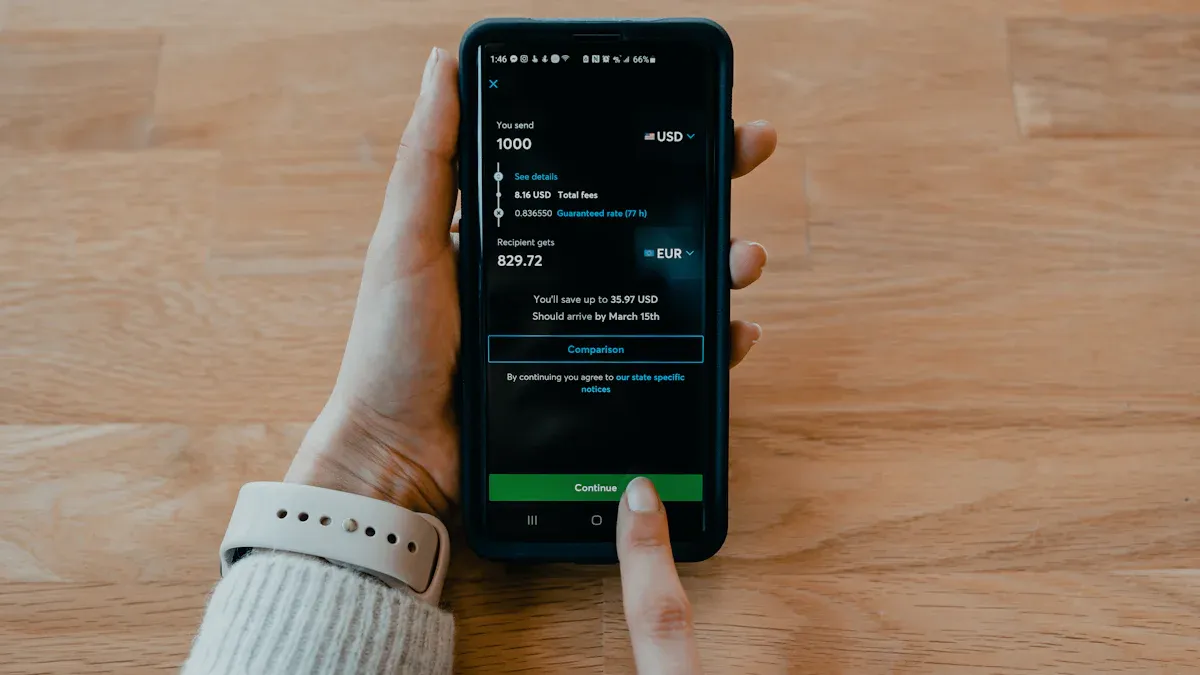

Wise Online Platform Process

Wise (formerly TransferWise) is a globally renowned online remittance platform that uses the mid-market rate and charges only a transparent service fee, maximizing the amount the recipient receives. Its service fee varies by currency pair, starting from about 0.43%.

Wise supports direct transfers to the recipient’s Alipay or WeChat Pay account, with a very intuitive process:

- Log into your Wise account.

- Click “Recipient” and add a CNY recipient.

- In “Bank details,” select Alipay or WeChat Pay as the receiving method.

- Enter the recipient’s name and Alipay/WeChat ID.

- After setting the amount, Wise clearly shows the rate, fee, and estimated delivery time.

- Confirm details, complete payment, and track progress.

💡 Friendly Reminder: Prepare Recipient Proof Documents Due to strict foreign exchange controls in China, for first-time or large Wise transfers to China, the recipient may need to provide documents proving fund purpose. Communicate with the recipient in advance to prepare relevant documents for smooth crediting. Common purposes and required documents include:

- Family Living Expenses: Provide proof of relationship, such as household register, marriage certificate, or birth certificate.

- Salary Income: Provide employment contract, payslip, or tax proof.

- Goods or Services Payment: Provide relevant transaction contract, invoice, or platform sales records.

Other Options: Western Union and DBS Remit

Besides the two mainstream methods, other options suit specific needs.

- Western Union If you need small, fast cash transfers, consider Western Union. In Taiwan, you can use partner locations like Chinatrust Commercial Bank. Fees start from $7, suitable for urgent cash needs without a bank account, but rates are usually poor.

- DBS Bank DBS Remit (Cross-Border Fast Transfer) If you’re a DBS customer, DBS Remit is highly attractive. It offers zero handling fees and up to same-day delivery. However, note these key conditions:

- Cutoff Time: For same-day arrival, complete setup before 3:00 PM on a bank business day.

- Rate Cost: Though fee-free, the bank adds a markup to the rate as profit—this is a hidden cost.

- Recipient Info: Prepare the recipient’s full English name, address, bank name, SWIFT Code, and account number.

In summary, each channel suits specific scenarios. Understanding these details helps you make the wisest decision when sending money.

How to Choose the Best Remittance Method? Three Scenario Analyses

After learning the pros and cons of each channel, you might ask: “Which should I choose?” There’s no standard answer—it depends entirely on your needs. Below, we analyze three common scenarios to help you decide quickly.

Scenario 1: Small Amount, Lowest Cost Priority

If you’re sending just a few thousand or tens of thousands NTD for living expenses or to relatives, “total cost” is the top priority. In this case, online remittance platforms usually outperform traditional banks.

Bank wires have minimum handling fees and fixed cable charges; even small amounts cost several hundred NTD. In contrast, platforms like Wise charge proportional fees and use fairer mid-market rates.

Rate Markup: The Hidden Devil Many remittance services profit from “rate markup”—adding a spread to the market rate. Even with low visible fees, this hidden cost can be significant. Choosing a transparent fee and rate platform ensures every dollar is well spent.

Scenario 2: Large Amount, Security Priority

When sending hundreds of thousands or millions NTD, such as for payments or asset purchases, transaction security and compliance become the most important. Traditional bank wires remain most people’s first choice.

Through banks, all processes are strictly regulated, with clear fund traceability. When processing, prepare the following to ensure smoothness:

- Recipient bank’s SWIFT Code

- Recipient’s full bank account number

- Recipient’s English name and address

- Clear remittance purpose

Banks may request proof of fund source or transaction documents; though more paperwork, this is crucial for both parties’ transaction safety.

Scenario 3: Urgent Need, Fastest Speed Priority

For emergencies needing funds to arrive ASAP, “speed” is everything. Some online platforms and specific bank services meet instant needs.

For example, platforms like Panda Remit or Ria offer “minute-level” delivery directly to the recipient’s Alipay or bank account. Additionally, DBS Bank’s DBS Remit provides same-day delivery.

💡 Note Bank “Cutoff Times” Whether bank or online platform, for same-day or instant delivery, complete operations before the provider’s cutoff time. Missing it defers your China remittance request to the next business day, so confirm in advance.

There’s no absolute best way to send money to China—only the one most suitable for your needs. Bank wires offer security for large amounts, while online platforms excel in small amounts, efficiency, and low cost. Before clicking send, do a final confirmation.

Final Pre-Remittance Checklist

- Recipient Info: Double-check name, bank, account number, and SWIFT Code.

- Total Fees: Compare handling fees and rate total cost.

- Annual Limits: Confirm amount doesn’t exceed your and recipient’s annual quotas.

- Proof Documents: Prepare remittance purpose proof in case of verification.

FAQ

What recipient details are needed to send money to China?

You need the recipient’s English name, bank name, bank account number, and SWIFT Code. For online platforms sending to Alipay or WeChat, you need the recipient’s verified account ID. Accurate information is key to smooth delivery.

Why is my remittance stuck or delayed?

Common delay reasons are three:

- Incorrect recipient information.

- Taiwan or China holidays when banks are closed.

- Recipient has reached the equivalent $50,000 annual receipt limit.

What is the SWIFT Code mentioned in bank wires?

The SWIFT Code is the bank’s unique identifier in the international financial network—like a bank’s “international ID number.” You must provide this code for overseas wires to accurately reach the recipient bank.

Can I send money to a company account in China?

Yes, but the process differs from personal remittances. Sending to company accounts is commercial; you need to provide transaction contracts, invoices, etc., to the bank. Due

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

How to Choose US Major Indices: Pros and Cons Analysis of S&P 500, Dow Jones, and Nasdaq

Is the W-8BEN Form Required for Opening a US Stock Account? Understand How to Save on Taxes in One Article

Annual Review: Best Performing US Stock ETFs in 2026 and the Logic Behind Them

Micro Dow, Micro Nasdaq, Micro S&P Futures Comprehensive Comparison – Helping You Find the Best Trading Choice

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.