Review of Popular USD to RMB Apps in 2025: Exchange Rates and Speed Comparison

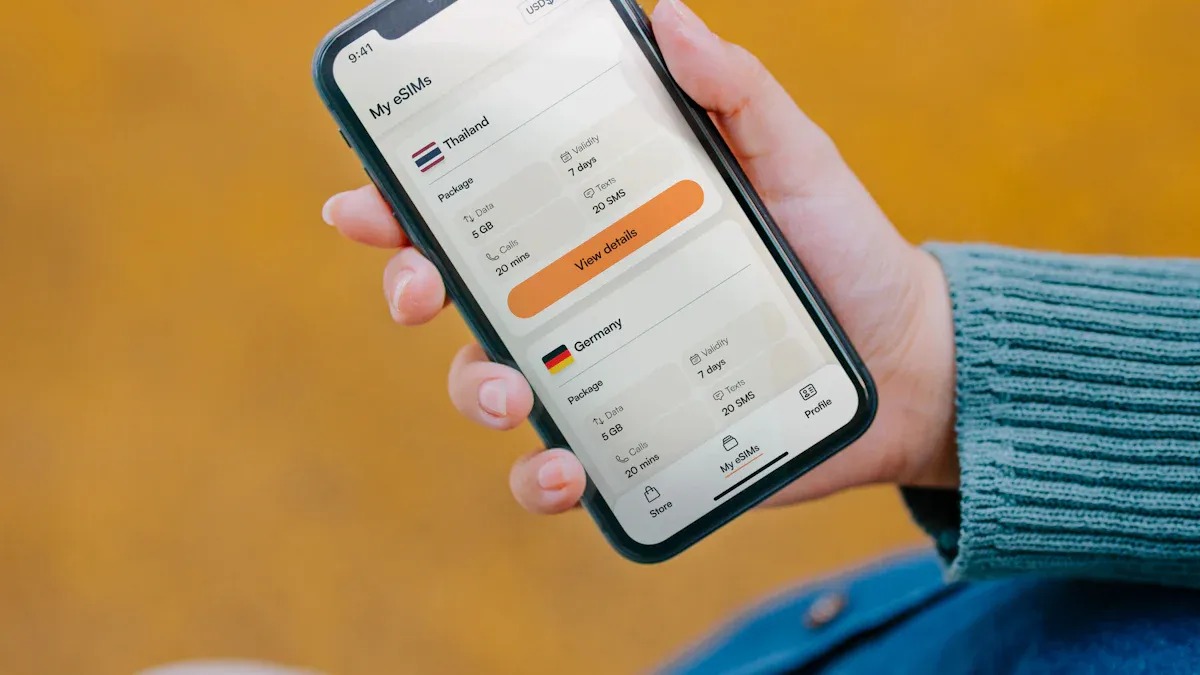

Image Source: pexels

If you are looking for the best USD to RMB app, we reveal the answer directly for you. Considering exchange rates, speed, and security, the most recommended choices currently are MoneyGram and Wise.

MoneyGram usually provides better exchange rates and new user promotions, while Wise is known for its clear and transparent fee structure and stable service.

Next, we will conduct in-depth reviews to help you make the most suitable choice based on your different requirements for speed or cost.

Key Takeaways

- MoneyGram and Wise are the best apps for converting USD to RMB, with good exchange rates, fast speeds, and high security.

- MoneyGram offers better exchange rates and fee-free promotions for new users, while Wise has transparent fees and uses real exchange rates.

- Panda Remit provides fast arrival services and Chinese customer support, suitable for users needing assistance.

- When choosing an app, you should compare total costs (exchange rates and fees), and consider remittance speed and amount limits.

- These apps are all regulated by governments and use bank-level security technology to protect your funds and personal information.

In-Depth Reviews of Popular USD to RMB Apps

Image Source: unsplash

To give you a clearer understanding of each app’s features, we have conducted in-depth reviews of the three most popular apps on the market. You can find the tool that best meets your remittance needs based on this detailed information.

MoneyGram: Exchange Rate Advantage and Convenient Experience

Recommendation Rating: ★★★★★

Core Advantages: MoneyGram’s biggest attraction is that it often provides highly competitive exchange rates for users, especially promotional rates for new users’ first transfers, allowing you to maximize the received amount. Its operation process is very simplified; even first-time users can easily get started.

New User Promotion: MoneyGram usually offers a 0 fee promotion for first transfers, along with a promotional exchange rate higher than the market average. This is a very practical benefit that can save you money on your first transfer.

Review Dimensions:

- Real-Time Exchange Rate Comparison: The exchange rate is very competitive, especially with new user promotions. It is worth checking first for large transfers.

- Fee Structure: Fees vary based on your chosen transfer speed. Usually, selecting the “economy” mode (3-5 business days arrival) has lower fees, while the “express” mode (arrival in minutes) has slightly higher fees.

- Estimated Arrival Speed: Offers two options; you can decide based on your urgency. Express service can arrive in the recipient’s Alipay account in as little as minutes.

- Supported Receiving Methods: Supports Alipay and UnionPay cards.

Note: MoneyGram currently does not support WeChat receiving; if you want to transfer directly to WeChat change, consider other options.

- Security:

- MoneyGram is registered with and regulated by the Financial Crimes Enforcement Network (FinCEN) in the US.

- It holds remittance licenses in multiple countries worldwide and is a compliant and trustworthy platform.

- Operational Convenience: The app interface is intuitive with clear guidance. You can complete the entire process from registration to initiating a transfer in just a few steps, with a very smooth experience.

- Per Transfer and Annual Limits: MoneyGram uses a tiered limit system. Typically, your basic limits are as follows:

Time Period Standard Limit (USD) Within 24 Hours 2,999 Within 30 Days 10,000 Within 180 Days 18,000 After submitting more identity verification information, you can apply to increase the limit, with a maximum per transfer of 60,000 USD.

Wise: Transparent Fees and Multi-Currency Expert

Recommendation Rating: ★★★★★

Core Advantages: Wise (formerly TransferWise) has a core philosophy of “transparency.” It uses the mid-market exchange rate for conversions, which is the real rate you see on Google, with no hidden markups. Additionally, its multi-currency account feature is very powerful, allowing you to hold and manage over 40 currencies like a local.

What is the Mid-Market Exchange Rate? Traditional banks and some exchange services add a markup to the real rate for profit. Wise is completely different; it lets you convert at the fairest rate, charging only a publicly transparent service fee.

Review Dimensions:

- Real-Time Exchange Rate Comparison: Public and transparent, always using the mid-market rate. You can see the real USD to RMB rate anytime in the app.

- Fee Structure: Wise’s fees are completely transparent, consisting of a fixed fee and a percentage-based variable fee. Before initiating a transfer, you will clearly see the total fee required.

Provider Exchange Rate Transfer Fee (USD) Recipient Receives for Sending 1,000 USD (CNY) Wise 7.06215 (Mid-Market Rate) 13.43 6,967.31 Traditional Bank (Example) 6.79191 (With Markup) 0.00 6,791.91 - Estimated Arrival Speed: Very fast; most transfers to China can be completed within one business day or even hours.

- Supported Receiving Methods: Supports Alipay, WeChat, and UnionPay cards, covering the most mainstream receiving channels in mainland China.

- Security:

- Wise is regulated by FinCEN in the US and the Financial Conduct Authority (FCA) in the UK.

- It holds corresponding financial licenses worldwide and is a large, compliant, publicly listed fintech company.

- Operational Convenience: Both the app and website interfaces are very modern, feature-rich but easy to use. You can easily track transfer status and manage multiple currencies.

- Per Transfer and Annual Limits: Wise’s limits are relatively high. After identity verification, the per transfer limit from the US can reach high levels, sufficient for most personal remittance needs.

Panda Remit: High Exchange Rates and Excellent Customer Service

Recommendation Rating: ★★★★☆

Core Advantages: Panda Remit has an excellent reputation among overseas Chinese and international students. It is known for its “instant arrival” speed and equally competitive high exchange rates. One of its biggest highlights is providing 24/7 full-time Chinese customer service, allowing you to communicate without barriers and get timely help when encountering issues.

Review Dimensions:

- Real-Time Exchange Rate Comparison: Panda Remit’s exchange rates are very attractive, with markup limits usually controlled within 0.5%, often providing better USD to RMB prices than banks in many cases.

- Fee Structure: Usually charges a fixed fee and often provides fee-free coupons for new users.

- Estimated Arrival Speed: Speed is its trump card advantage. Most transfers received via Alipay or WeChat can be completed in minutes, truly achieving “instant arrival.”

- Supported Receiving Methods: Fully supports Alipay, WeChat, and UnionPay cards, perfectly matching mainland China users’ habits.

- Security:

- Panda Remit holds payment licenses in multiple countries worldwide and is a compliant remittance service provider.

- The platform uses bank-level encryption technology to protect your funds and personal information security.

- Operational Convenience: The app design fully considers Chinese users’ habits, with a friendly interface and simple operation.

- Excellent Customer Service: Based on extensive user feedback, Panda Remit’s customer service responds quickly and professionally. On platforms like Trustpilot, it has over 800 reviews with an overall rating of 4.1 stars (out of 5 stars), with users generally praising its efficiency and reliability.

- Per Transfer and Annual Limits: Per transfer limit is usually 3,000 USD, suitable for most daily remittances and small living expenses.

More Exchange App Choices

Image Source: unsplash

In addition to our key recommendations of MoneyGram and Wise, there are other remittance apps on the market worth your attention. They have different focuses and may meet your specific needs.

Western Union: Traditional Giant with Offline Network

Western Union is a household name. Its biggest advantage is its extensive offline outlets worldwide, providing cash pickup convenience for recipients without bank accounts.

Western Union’s fees and exchange rates vary based on payment and receiving methods. You can use its online price calculator to compute costs. Enter the remittance amount (up to 7,000 USD), and the system will show the amount the recipient will receive, transfer fees, and total cost.

Core Advantage: If your recipient needs to directly pick up cash in mainland China, Western Union is almost the only choice.

Xoom: PayPal Subsidiary with System Integration

Xoom is a remittance service under PayPal. If you are an old PayPal user, Xoom provides great convenience.

- You can directly log in to Xoom using your PayPal account.

- Bank accounts, credit cards, or debit cards saved in PayPal can be seamlessly used for payment, without re-entering information.

- This integration simplifies the payment process, making remittances faster.

When conducting USD to RMB transactions, Xoom’s speed is also very competitive.

- Bank Deposit: Funds usually arrive in most major Chinese banks within 30 minutes.

- Mobile Wallet: Transfers to mobile wallets usually arrive in minutes.

Xoom’s fees depend on various factors, but bank transfers are usually the lowest cost option.

Sky Remit: WeChat Ecosystem with Low Fees

Sky Remit is a remittance platform focused on WeChat receiving. If you want to directly transfer funds to the recipient’s WeChat change, it is a very direct and efficient choice. The platform attracts many users with its lower fees and good exchange rates, and the operation process is quite simple.

Azimo: Focused on Alipay Receiving

Similar to Sky Remit, Azimo focuses on Alipay receiving. It provides users with a simple and clear remittance path, specifically serving users who want to receive via Alipay. If you and your recipient are accustomed to using Alipay, Azimo is worth considering.

Ultimate Guide to Choosing an Exchange App

With so many choices, you might feel confused. Don’t worry; this guide will help you quickly lock in the most suitable app based on your specific needs.

How to Choose the App Most Suitable for You?

You can refer to the following suggestions based on your primary considerations:

- If you pursue the lowest cost 💰 You cannot just look at fees. The real cost is the sum of “exchange rate difference” and “fees.” You should focus on “sending 1,000 USD, how much RMB the recipient ultimately receives.”

Action Suggestion: Before remitting, open MoneyGram and Wise simultaneously, enter the same amount for comparison. MoneyGram’s new user promotional exchange rate is usually very attractive.

- If you pursue the fastest speed ⚡ Most apps offer “express” options, arriving in minutes. Panda Remit is widely praised by users for its “instant arrival” reputation. However, note that although the platform claims arrival in minutes, the final speed sometimes depends on the receiving bank’s processing time.

- If you need large remittances 🏦 You need to pay special attention to each app’s per transfer and annual limits. Some platforms will significantly increase your remittance limit after verifying your identity. For example, to increase Western Union’s sending limit, you need to submit government-issued ID online or via the app. After verification, your sending limit will increase significantly.

Key Indicators Comparison Table

To make it clear at a glance, we have compiled this core indicators comparison table. You can use it to quickly screen and find the app that best meets your USD to RMB needs this time.

| App Name | Reference Exchange Rate (Sending 1000 USD) | Fee (USD) | Fastest Arrival Time | Main Receiving Methods |

|---|---|---|---|---|

| MoneyGram | Promotional rate, usually high | Varies by speed, new user promotion | Minutes (Express) | Alipay, UnionPay Card |

| Wise | Mid-Market Rate (e.g., 7.062) | Fixed + Variable Fee, Transparent | Hours to 1 Business Day | Alipay, WeChat, UnionPay Card |

| Panda Remit | High, Competitive | Fixed Fee, New User Promotion | Minutes | Alipay, WeChat, UnionPay Card |

| Western Union | Varies by Payment Method | Varies by Service | Minutes | UnionPay Card, Cash |

| Xoom | Includes Spread | Varies by Service | Minutes | UnionPay Card |

| Sky Remit | Good | Low | Minutes | |

| Azimo | Good | Low | Minutes | Alipay |

Please Note: Exchange rates and fees in the table are for reference only; actual data changes in real time. It is recommended to confirm the final received amount in the app before transferring.

After comprehensive reviews, we summarize the core views for you: For most users, MoneyGram and Wise are the top choices balancing exchange rates, speed, and security. These two apps have received high ratings of over 4.2 points (out of 5 points) on platforms like Trustpilot, proving the reliability of their services.

Your final choice can be based on the following considerations:

- If you pursue the best exchange rate and first-time promotion, MoneyGram with its simplified operation process is your top choice.

- If you value fee transparency and long-term stability, Wise with its clear interface and real mid-market exchange rate becomes a reliable partner.

- For users needing excellent Chinese customer service, Panda Remit is also worth considering.

We encourage you to refer to the “Key Indicators Comparison Table” in the article, combine your remittance amount and speed requirements, and make the most informed personal decision.

Common Questions

We have compiled some common questions about USD to RMB to help you better understand the entire process.

Are These Exchange Apps Safe?

You can use them with confidence. These apps are strictly regulated by institutions like the US Treasury’s Financial Crimes Enforcement Network (FinCEN). They use bank-level encryption technology to fully protect your funds and personal information security.

Do Remittances to Mainland China Require Tax Payment?

- Recipient: Personal gift remittances, under current policies, usually do not count as the recipient’s taxable income.

- Sender: You need to comply with US tax regulations. If your annual gift total exceeds a certain limit (e.g., over 18,000 USD), you may need to report it.

Why Is the Exchange Rate in the App Different from What I Searched Online?

The rate searched online is usually the mid-market exchange rate. Most service providers add a small spread as profit on top of this. Wise is an exception; it directly uses the mid-market exchange rate. Therefore, it is best to check the final received amount directly in the app.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Review of the 2025 Shanghai Composite Index: Can It Start a Healthy Bull Above 4000 Points?

2025 Taiwan Stock Market Year-End Review and 2026 Outlook: Can the AI Boom Continue?

Ultimate Guide to Applying for a Schengen Visa in the USA in 2025: Understand the Process, Documents, and Timeline in One Article

Understand the Core Differences Between the Nasdaq Composite Index and Nasdaq 100 Index in One Article

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.