Detailed Explanation of Remitly Registration Process: How New Users Can Remit Money Securely and Quickly

Image Source: pexels

Do you want to quickly transfer money to mainland China? You can easily complete account creation and identity verification through the Remitly registration process. You only need to prepare basic information and follow the on-screen prompts to safely set up transfer details and choose the appropriate delivery speed. You can stay in control of every step, ensuring funds reach the designated recipient securely.

Key Points

- Registering a Remitly account is simple and fast, requiring only basic information and email verification.

- Ensure the personal information you provide is accurate to avoid registration failure or transfer delays.

- Choose the appropriate transfer speed and payment method; Economy transfers suit non-urgent cases, while Express transfers are ideal for urgent needs.

- When using Remitly, pay attention to transfer limits and fees, and select the most suitable service plan.

- Regularly check account security settings and enable two-factor authentication to protect funds.

Remitly Registration Process

Image Source: pexels

The Remitly registration process is very simple, and you can complete account creation in just a few minutes. You only need to follow the steps below to smoothly begin your money transfer journey.

Visit the Website or Download the App

You can start the Remitly registration process in two ways:

- Visit the Remitly official website.

- Download the Remitly mobile app (available for iOS and Android).

- Find the “Sign Up” button on the homepage and click to enter the registration page.

- Enter your email address and set an account password.

- Read and agree to the terms of service.

You can choose to operate on a computer or mobile phone, and the system will automatically guide you to the next step. Whether you are in the United States or mainland China, you can smoothly complete the above steps.

Fill in Basic Information

You need to fill in personal basic information on the registration page, including:

- Name (consistent with your ID)

- Country and region of residence

- Phone number

- Email address

Please ensure all information is accurate. The system will automatically match the appropriate transfer service based on the information you provide. The information you enter will be used for subsequent identity verification and security protection.

Tip: Carefully verify the information you enter to avoid registration failure or transfer delays due to errors.

Email Verification

After registration, the system will send a verification email to your inbox. You need to:

- Open your email and find the verification email sent by Remitly.

- Click the verification link in the email to activate your account.

- Return to the Remitly page to complete subsequent settings.

Email verification is a critical step in the Remitly registration process, effectively preventing others from registering an account with your email. You must complete email verification to officially use the transfer function.

Security of the Registration Process

The Remitly registration process places a high priority on user information security. You will encounter multiple security measures during registration:

| Security Measure | Description |

|---|---|

| Account Verification Process | New users must provide personal information and complete email verification to ensure account security. |

| Password Security | Uses secure server connections during login with 256-bit encryption to protect accounts; users must create complex passwords to enhance security. |

| Phishing and Fraud Prevention | Monitors suspicious activity through manual and automated risk management programs to prevent misuse of user information. |

You can confidently enter personal information, as Remitly protects your account security through encryption technology and risk management programs.

Latest Registration Policies and Service Updates

You can also experience Remitly’s latest services during registration:

| Update | Description |

|---|---|

| Remitly Flex Service | Allows users to receive advances on transfer activities without additional fees. |

| Accelerated Funds Option | Users can pay an additional fee to speed up fund delivery. |

| Fee Structure | Remitly Flex charges no mandatory fees or interest; users can opt for a $3.99 acceleration fee. |

You can choose different delivery speeds and service plans based on your needs, enjoying a more flexible transfer experience.

After completing the above steps, the Remitly registration process is complete. You can proceed with identity verification and transfer setup to start a secure and fast international transfer service.

Identity Verification

Image Source: pexels

After completing the Remitly registration process, you need to perform identity verification. This step helps the platform confirm your identity, ensuring account and fund security. You need to follow the on-screen prompts to upload relevant identification documents and provide accurate personal information.

Upload Identification Documents

You need to prepare valid identification documents. Remitly supports various types of documents, commonly including:

| Identification Document Type |

|---|

| Government-issued ID |

| Financial documents (e.g., bank statements or payslips) |

| Proof of address (e.g., utility bills) |

You can choose to upload any of the following documents:

- Government-issued ID (e.g., passport or driver’s license)

- Proof of address (e.g., utility bill)

When uploading, ensure the document content is clear and complete. You can take a photo or scan the document with your phone and upload it as per the system’s instructions. The platform will encrypt your files to protect your privacy.

Tip: The uploaded documents must be valid and authentic. If the information does not match, the system may reject your application, affecting subsequent transfer operations.

Personal Information Entry

After uploading identification documents, you need to fill in detailed personal information, including your name, date of birth, and residential address. The information you provide must match the identification documents. This ensures faster verification and reduces unnecessary delays.

Remitly typically completes the review within a few minutes to a few hours after you submit your documents. You can check the verification progress on your account page at any time. If there is a delay in verification, you can wait patiently or contact customer service for assistance.

Note: Identity verification is a critical step in protecting your account security. Ensure all information is accurate to avoid verification failure due to errors.

Transfer Information Setup

Select Sending and Receiving Currency

When setting up transfer information, you first need to choose the sending and receiving currencies. Remitly supports multiple countries and currencies, allowing you to select based on your needs. For example, if you are sending money from the United States to mainland China, you can choose USD as the sending currency and CNY as the receiving currency. The table below shows some common countries and their corresponding currencies:

| Country | Currency |

|---|---|

| United States | USD |

| China | CNY |

| Australia | AUD |

| Canada | CAD |

| United Kingdom | GBP |

| Germany | EUR |

| Japan | JPY |

| Brazil | BRL |

| Albania | ALL or EUR |

| Algeria | DZD or EUR |

| Other Countries | Various Currencies |

You can select the appropriate currency based on the recipient’s location. The system will automatically display available options to help you complete the setup quickly.

Enter Transfer Amount

You need to enter the transfer amount on the page. Remitly will automatically calculate the exchange rate and fees based on your selected sending and receiving currencies. All amounts are displayed in USD, making it easy for you to understand the actual payment amount. You can enter any amount based on your needs, and the system will display the recipient’s received amount and estimated delivery time in real-time. You can review all information on the confirmation page to ensure accuracy before submitting.

Tip: When entering the amount, note the platform’s minimum and maximum limits. The system will automatically notify you if the amount exceeds the limit, helping you plan your transfer reasonably.

Recipient Information

You need to provide detailed recipient information, including their name, bank account, or mobile wallet details. Ensure all information is accurate when filling it out. Here are key points to note when entering recipient information:

- The accuracy of recipient information is critical when sending funds via Remitly.

- Once the transfer begins, you typically cannot change the recipient’s name, bank details, or mobile wallet information.

- If you notice errors in recipient information, the best option is to cancel the transaction (if it has not yet been completed).

- After cancellation, you can initiate a new transfer with the correct information to avoid delays or incorrect transfers.

- Carefully review recipient information before confirming the transaction to ensure smooth transfer and tracking.

You can choose to send funds to a licensed bank account in Hong Kong or select other receiving methods. Verify each step carefully to ensure funds reach the mainland China recipient securely.

Transfer Speed and Payment Methods

When using Remitly to send money to mainland China, you can choose different transfer speeds and payment methods based on your needs. Remitly offers two main service types: Economy and Express. These differ significantly in delivery speed and fees.

Economy Transfer

Economy transfers are suitable for scenarios where you are not in a hurry for funds to arrive and want to save on fees. You can use a bank account for the transfer, and funds typically arrive within 1-5 business days. Economy transfers have lower fees, making them ideal for large or planned transfers. The table below shows the main differences between Economy and Express transfers:

| Service Type | Transfer Speed | Fees (in USD) |

|---|---|---|

| Economy | 1-5 business days | $3.99 (below $1000) |

| Express | Usually within minutes | No fees for transfers below $1000 |

When choosing an Economy transfer, the system will display the estimated delivery time. You can plan funds in advance to ensure the recipient receives them on time. If you send funds to a licensed bank account in Hong Kong, the delivery speed may be affected by bank processing times.

Express Transfer

If you need funds to arrive quickly, you can choose the Express transfer service. You can pay with a debit or credit card, and funds typically arrive within minutes, with a maximum of 4 hours. Express transfers are suitable for emergencies or urgent needs. For transfers below $1000, Remitly usually does not charge additional fees. Refer to the table below for processing times of different payment methods:

| Payment Method | Processing Time |

|---|---|

| Debit Card | Instant |

| Credit Card | Instant |

| Bank Account | 1-5 business days |

You can flexibly adjust your payment method based on your funding source and delivery needs. If you want to save on fees, choose Economy transfers. If you prioritize delivery speed, opt for Express transfers.

Tip: When choosing transfer speed and payment method, consider your actual needs and the recipient’s urgency to plan fund transfers reasonably. Regardless of the method, Remitly ensures the safety of your funds.

Real-Time Tracking and Delivery

Track Transfer Status

You can monitor transfer progress at any time. Remitly provides multiple real-time tracking methods to keep you informed about fund movements. You can check transfer status through the following methods:

- You can directly view the latest status of each transfer on the Remitly app or website.

- The system sends real-time notifications via email or SMS, updating you on each step, including transfer initiated, in progress, and completed.

- You can track every step of the transaction on the account page, from sending to recipient receipt, with full transparency.

Tip: Notifications you receive can help you detect issues promptly. If you notice transfer delays or unusual status, contact Remitly customer service immediately to ensure fund safety.

Delivery Time

Delivery times vary based on the transfer method chosen. Remitly provides clear delivery time references based on payment channels and receiving methods. The table below shows the average delivery times for main transfer methods:

| Transfer Method | Average Time |

|---|---|

| Bank Transfer (e.g., to a licensed Hong Kong bank) | 3-5 business days |

| Credit/Debit Card Transfer | 1-3 business days |

| Cash Pickup | Within minutes |

| Mobile Wallet Transfer | 1-3 business days |

You can choose the appropriate method based on the recipient’s needs. For fast delivery, opt for cash pickup or credit/debit card transfers. For lower fees and fewer amount restrictions, choose bank transfers. You can view the estimated delivery time displayed by the system before transferring to plan fund movements reasonably.

Note: Delivery times may vary due to bank processing speeds, recipient location, and other factors. Monitor transfer status closely during the process to ensure funds reach the mainland China recipient safely and on time.

Fees and Limits

Fees

When using Remitly to send money to mainland China, fees vary based on the transfer route and amount. For transfers from the United States to China, the platform has not disclosed specific transaction fees. You can refer to fees for transfers from the United States to India as a reference:

| Sending Country | Transaction Fees | Notes |

|---|---|---|

| United States to India | 3.99 USD | First-time transfers may receive discounts; transfers over 1000 USD are fee-free |

| United States to China | N/A | No fee information available |

You can view the actual fees displayed by the system before transferring. The platform sometimes offers fee waivers or promotions for new users. Choose the most suitable service plan based on your transfer amount.

Tip: For transfers exceeding 1000 USD, some routes may be fee-free. Carefully review the fee details before submitting the transfer.

Exchange Rates

You need to pay attention to exchange rate changes when transferring. Remitly typically offers better rates for smaller transfers. The table below compares Remitly’s exchange rate markup with Western Union:

| Transfer Service Provider | Exchange Rate Markup | Notes |

|---|---|---|

| Remitly | 1-2% | Better rates for small transfers (e.g., below 500 USD) |

| Western Union | 2-4% | Recipients receive less for large transfers |

You can view the current exchange rate on the transfer page in real-time. The platform automatically calculates your actual payment and the recipient’s received amount. When transferring to a licensed bank account in Hong Kong, the system settles based on the day’s exchange rate.

Note: Exchange rates fluctuate daily. Compare rates across platforms before transferring to choose the most cost-effective option.

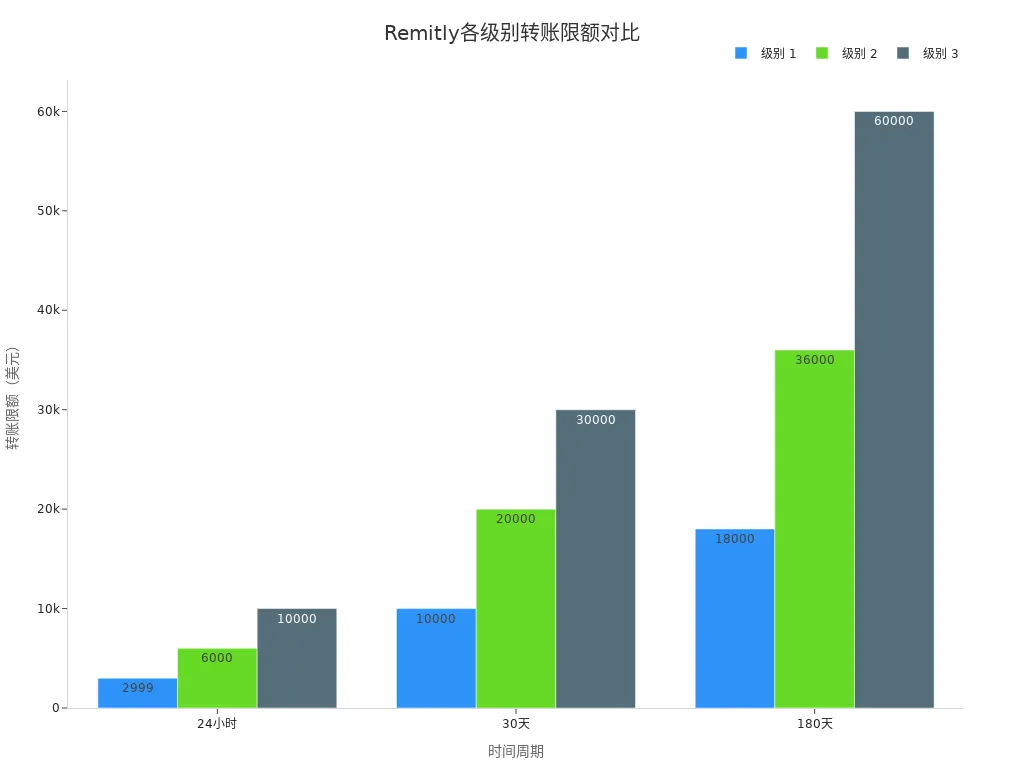

Transfer Limits

When using Remitly, the platform sets different transfer limits based on your account verification level. The table below shows the transfer limits for each level:

| Sending Limit | Level 1 | Level 2 | Level 3 |

|---|---|---|---|

| 24 Hours | $2,999 | $6,000 | $10,000 |

| 30 Days | $10,000 | $20,000 | $30,000 |

| 180 Days | $18,000 | $36,000 | $60,000 |

You can increase your transfer limit by completing higher-level identity verification. The chart below shows a comparison of transfer limits for different account levels over 24 hours, 30 days, and 180 days:

You can choose the appropriate account level based on your needs before transferring. The platform will automatically display your current limit, helping you plan fund transfers reasonably.

Tip: Increasing your account verification level raises your transfer limit. Complete identity verification in advance based on your needs.

Security Measures

Data Encryption

When registering and transferring with Remitly, the platform uses multiple encryption technologies to protect your personal information and fund security. Remitly employs 256-bit SSL encryption to ensure all data during registration and transfers remains secure. All transactions use advanced encryption to prevent personal and financial information leaks. The platform also uses industry-standard encryption methods to safeguard sensitive financial data. You can confidently enter information, as Remitly provides comprehensive protection for every operation.

- Remitly uses 256-bit SSL encryption to protect registration and transfer data

- All transactions use advanced encryption technology to ensure information security

- Industry-standard encryption methods safeguard sensitive financial data

Tip: You receive the same level of encryption protection even when operating on public networks.

Account Security

Your Remitly account is protected by multiple security measures. The platform requires authentic personal information and government-issued ID to prevent identity theft. You can enable two-factor authentication (2FA) via SMS verification to further enhance account security. Remitly also has a dedicated team and technology to monitor all transactions in real-time, promptly identifying and blocking suspicious activities. The table below shows key account security features:

| Security Feature | Description |

|---|---|

| Identity Verification | You must submit personal information and ID to prevent fraud and impersonation. |

| Two-Factor Authentication (2FA) | You can set up SMS verification to prevent unauthorized access. |

| Fraud Protection Measures | The platform monitors transactions in real-time to detect and block unusual activity. |

You can regularly check account security settings and update passwords. If you notice unusual logins or transactions, contact customer service immediately.

Customer Service

If you encounter any security issues while using Remitly, you can contact the customer service team at any time. Remitly is subject to strict oversight by financial regulators in multiple jurisdictions, ensuring every transfer complies with anti-money laundering (AML) and anti-fraud regulations. The platform also uses multi-factor authentication and real-time transaction monitoring to ensure fund security. If you experience unusual account activity, verification issues, or transfer delays, you can get help via online support, phone, or email.

Suggestion: Regularly check account security settings and contact Remitly customer service immediately for any questions or anomalies to ensure fund and information safety.

Notes

Information Entry

When registering a Remitly account or setting up transfer information, you must ensure all details are accurate. Common errors during information entry can affect transfer progress or lead to verification failure. Refer to the following points to avoid common mistakes:

- Spelling and grammatical errors can cause the system to fail to recognize your identity information.

- Mismatched personal information and account details can affect identity verification and fund security.

- Inaccurate email addresses or phone numbers may prevent you from receiving important notifications.

Tip: When entering your name, address, and contact details, cross-check with your identification documents. Accurate information speeds up verification and matches services automatically.

Handling Transfer Failures

If your transfer to a mainland China recipient fails, you can follow these steps to troubleshoot and resolve the issue:

- Log in to your Remitly account, go to the “Transfers” page, and check the current transfer status.

- If the status is unclear, refresh the page or check for alerts and emails sent by the system.

- If the transfer still does not appear, contact Remitly’s customer support team for detailed assistance.

- Verify the payment method, recipient information, and network connection to ensure all steps are correct.

You can quickly identify issues and ensure fund safety with these methods. For special cases, Remitly’s customer service will assist in resolving transfer issues.

Note: Monitor account notifications before and after transfers to address anomalies promptly and avoid fund delays.

Recipient Does Not Need to Register

When using Remitly to send money to mainland China, the recipient does not need a Remitly account to receive funds. The platform offers multiple convenient methods for recipients:

- Recipients can pick up cash directly at designated locations without a bank account.

- You can choose a prepaid debit card, allowing the recipient to receive funds easily.

You can select the most suitable receiving method based on the recipient’s needs. Whether the recipient has a bank account or not, they can receive your transfer smoothly.

Tip: When entering recipient information, confirm the withdrawal method and related details with the recipient in advance to ensure smooth fund delivery.

After completing the Remitly registration and transfer process, you can experience efficiency and security. During identity verification, you need to upload identification and proof of address, ensuring the information is authentic. The platform uses advanced encryption and two-factor authentication to ensure account security. Refer to the table below for key points new users should focus on:

| Step | Key Actions |

|---|---|

| Registration and Verification | Provide authentic name, address, date of birth, and identification |

| Transfer Setup | Verify recipient information and choose the appropriate delivery speed |

| Security Settings | Enable two-factor authentication and regularly check account security |

By following the process, you can enjoy a convenient and reliable transfer experience to mainland China.

FAQ

What should I do if I can’t verify my email during registration?

You can check if the email address is correct. You can look in the spam folder. You can resend the verification email. If you still don’t receive it, contact Remitly customer service.

What receiving methods are available for transfers to mainland China?

You can choose to send to a licensed bank account in Hong Kong. You can choose cash pickup. You can choose a mobile wallet. You can select flexibly based on the recipient’s needs.

Will funds be refunded if a transfer fails?

If your transfer fails, Remitly will automatically refund the funds. You can check the refund progress on the account page. You can contact customer service to confirm refund details.

How can I increase my transfer limit?

You can upload additional identification documents. You can complete personal information. You can complete advanced identity verification. You can view the current limit on the account settings page.

How are exchange rates and fees calculated?

You can view exchange rates and fees in real-time on the transfer page. All amounts are displayed in USD. Refer to the table below:

| Item | Description |

|---|---|

| Exchange Rate | Updated in real-time |

| Fees | Charged based on transfer amount |

Remitly’s registration is simple, completing account creation and ID verification in minutes with options like bank accounts and debit cards, but 1%-3% exchange markups and limits (e.g., $2,999/24 hours) can add costs, especially in 2025’s $80+ trillion remittance market, where traditional providers’ verifications slow transactions. For a cost-effective, seamless cross-border solution, explore BiyaPay. With remittance fees as low as 0.5%, BiyaPay ensures maximum recipient value with full transparency.

BiyaPay serves most countries and regions, with registration in minutes and same-day delivery, no complex checks required. Plus, trade stocks in US and Hong Kong markets without an overseas account, featuring zero fees on contract orders. Sign up today and use the real-time exchange rate tool to monitor current rates, optimizing your transfer timing for a secure, budget-savvy global finance experience.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

A Blessing for Small Investors: Finding the Lowest Trading Cost US Stock Brokers

US Stock Index Futures Trading Secrets: Master the Four Major Indices to Unlock Wealth Opportunities

Master US Stock Trading Hours in One Article: Never Miss Pre-Market and After-Hours Opportunities

US Stock Broker Opening Guide: Fees, Security, and App Experience Comparison (Futu vs Tiger vs Firstrade)

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.