- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Why Is the Standard Chartered Mobile App So Popular?

Image Source: unsplash

Have you ever tried handling banking tasks on your phone? The Standard Chartered Mobile App helps you manage account checking, transfers, investments, and credit card services all in one app. The interface is simple, and the functions are clear at a glance, allowing you to manage your finances anytime, anywhere in Hong Kong.

With the Standard Chartered Mobile App, you no longer need to queue at the bank. In just a few minutes, you can check your account balance and even transfer money to friends instantly, saving you plenty of time!

Key Highlights

- The Standard Chartered Mobile App integrates multiple functions such as account checking, transfers, investments, and loan applications, allowing you to manage finances easily with one app.

- The interface is designed to be simple and clear, easy to operate, enabling users to quickly find the functions they need, saving time on banking.

- The app provides multiple security measures, including biometric authentication and SC Mobile Key, ensuring your funds are safe and worry-free.

- 24/7 service support allows you to check accounts, make transfers, and apply for loans anytime, anywhere, making banking more flexible.

- Instant notifications and account alerts help users stay on top of account activities, detect anomalies early, and boost confidence in managing finances.

Main Features

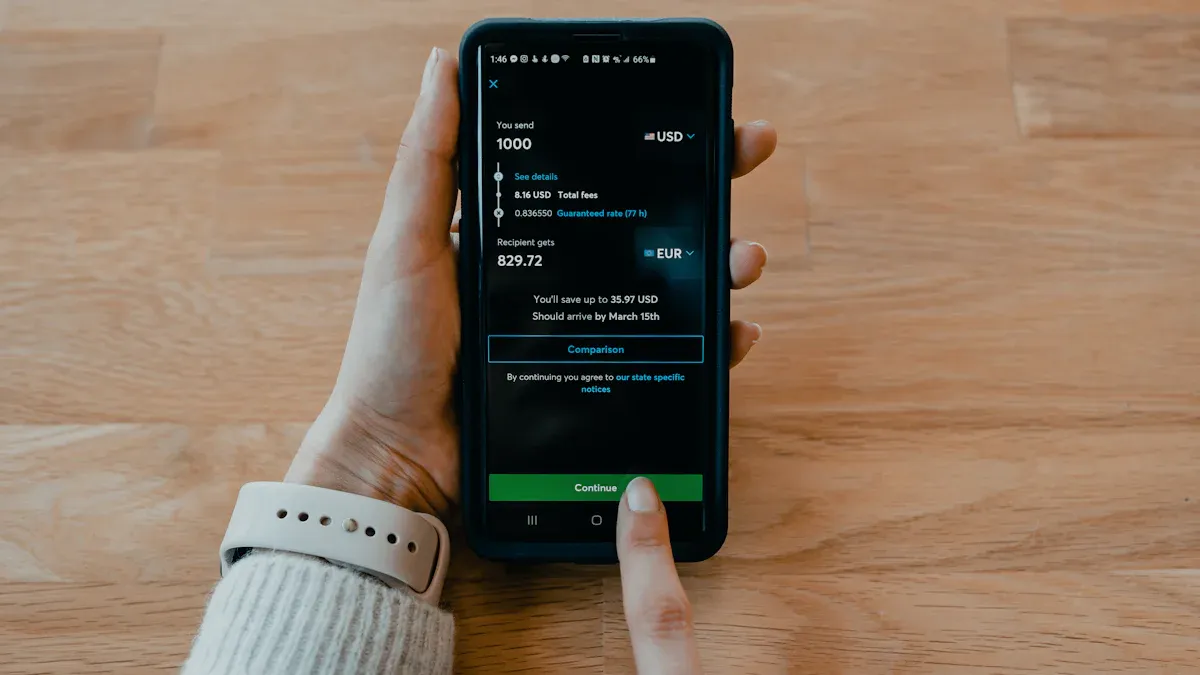

Image Source: pexels

Account Management

You can use the Standard Chartered Mobile App to check all account balances anytime, whether it’s savings, checking, or foreign currency accounts, all displayed clearly. To view past transaction records, it takes just a few clicks. You can also open a new account directly without visiting a branch. Monthly e-statements can be downloaded anytime, making it convenient to manage finances and keep records.

Tip: You can set account alerts to receive instant notifications for large transactions or account changes, ensuring the safety of your funds.

Transfers and Payments

To transfer money to friends or family, you can choose local bank transfers, FPS, or SC Pay. The Standard Chartered Mobile App supports multiple transfer methods, allowing you to handle various payment needs flexibly. You can also pay utility bills, phone bills, and other daily expenses. The preset payee management function makes future transfers faster.

- Local bank transfers

- FPS instant transfers

- SC Pay mobile number transfers

- Bill payments

- Preset payee management

Credit Card Services

You can check your credit card statement anytime to review monthly spending details. Repayments are equally convenient, completed in just a few steps. To apply for a new credit card, you can submit an application directly in the app without filling out complex forms. You can also set up automatic repayments to avoid late payment penalties.

The app reminds you of repayment dates, helping you avoid late payments and maintain a good credit record.

Investment and Wealth Management

If you want to invest in stocks, funds, or forex, the Standard Chartered Mobile App can assist you. You can check real-time market trends and place orders instantly. Based on past simulated data, stock and fund returns are affected by market fluctuations. Historical data shows that a dollar-cost averaging strategy helps reduce average costs, and when the market rebounds, returns may rise. A top-up strategy (increasing investments during market dips) can also help improve 1- to 3-year returns. However, past performance does not guarantee future results, so you should make choices based on your risk tolerance.

- Real-time trading for stocks, funds, and forex

- Dollar-cost averaging investment options

- Portfolio overview

- Market information and simulated return data for reference

Loan Applications

If you need cash flow, you can apply for personal loans or mortgages directly in the Standard Chartered Mobile App. Simply fill in basic information, and the system will display approval results instantly. You can compare interest rates and repayment terms of different loan products to choose the best option. All application progress can be tracked within the app, making it convenient and transparent.

You can check loan repayment dates and remaining balances anytime, making financial planning more organized.

Standard Chartered Mobile App Features

New Homepage

When you open the Standard Chartered Mobile App, the first thing you see is the newly designed homepage. The homepage is clean and simple, displaying all account balances, credit cards, and investment statuses clearly. You can customize frequently used functions, placing your most-used services on the homepage for quick access. This saves you time searching, making banking more efficient.

Tip: You can use the homepage to quickly check all account activities, reducing the chance of missing important information.

24/7 Service

The Standard Chartered Mobile App offers round-the-clock service. Whether you’re in Hong Kong or overseas, you can log in anytime to check accounts, make transfers, invest, or apply for loans. You’re no longer restricted by bank operating hours, making banking more flexible.

- You can check accounts at midnight

- You can make transfers on holidays

- You can apply for loans anytime

Cardless Withdrawal

At Standard Chartered ATMs, you can withdraw cash by scanning a QR code with your phone, without needing a physical card. This cardless withdrawal feature (QR Cash) makes going out lighter and reduces the risk of losing your card. Simply preset the withdrawal amount in the app and scan the code at the ATM to complete.

Note: Each cardless withdrawal includes security verification to protect your funds.

SC Mobile Key

SC Mobile Key is a feature that enhances security. Once activated, the system automatically verifies your identity for logins or important transactions, eliminating the need for one-time passwords. This is both convenient and secure, reducing the risk of unauthorized access.

- You can use fingerprint or facial recognition

- You no longer need to memorize multiple passwords

Usability and Security

Image Source: unsplash

Simple Interface

When you open the Standard Chartered Mobile App, you’ll notice its very simple interface design. All buttons and icons are consistent, with clear colors, allowing you to find the needed functions at a glance. According to user research, simple design helps you learn to operate faster.

- Surveys show that most users find a simple interface makes account management easier.

- Tests found that immediate feedback after operations confirms each step’s success.

- Key functions like account checking and transfers are placed prominently, reducing search time.

These design principles not only improve efficiency but also reduce the chance of errors.

Multi-Language Support

You can choose languages like Chinese or English based on your needs. The Standard Chartered Mobile App supports multiple languages, accommodating users from different backgrounds. Simply switch languages in the settings, and all functions and prompts will change instantly. This allows you to manage finances easily in any language.

Tip: If you have elderly family members, you can choose the language they’re most familiar, reducing communication barriers.

Biometric Authentication

You can unlock the app with a fingerprint or biometric authentication, enhancing security. Many Hong Kong banks now adopt biometric technology. These technologies effectively prevent identity theft and account fraud. In 2023, financial regulators pushed for standardized verification processes to reduce fraud risks. After major Korean banks introduced facial recognition, they successfully established a zero-trust security environment. Cases in Taiwan and Japan show that accounts without biometric authentication are more vulnerable to theft, with losses amounting to millions of dollars (USD], calculated at the exchange rates, impacting both banks and users significantly.

With biometric authentication enabled, you can bank with greater peace of mind.

- Fingerprint authentication

- Biometric authentication

- Biometric authentication

- Dual authentication

Real-Time Notifications

Every time there’s an account change, transfer, or transaction, you’ll receive instant notifications from the app. These real-time alerts help you detect anomalies immediately, ensuring the safety of your funds. You can customize notification preferences, such as receiving only large transactions or specific types of messages. This keeps you informed about account activities, reducing risks.

After setting up real-time notifications, you won’t worry about missing critical information, boosting your confidence in banking.

You can manage your finances anytime, anywhere with the Standard Chartered Mobile App. This app integrates multiple functions with a simple operation and high security. Whether checking accounts, transferring money, investing, or applying for loans, it’s all done in one app.

Mobile banking will become even more convenient in the future, and you can try it yourself to experience the new era of era of banking.

FAQ

What mobile operating systems does supported by the Standard Chartered Mobile App support?

You can download and use the Standard Chartered Mobile App on iOS and Android phones. Simply search for “Standard Chartered Bank” in the App Store or Google Play to install.

Are there any fees for transfers?

Using FPS or SC Pay for local transfers is generally free. Cross-border transfers or specific services may incur fees, calculated in US dollars (USD); please refer to the bank’s latest exchange rates.

How can I protect my account if I lose my phone?

You should immediately call the Standard Chartered Bank hotline. The bank will suspend your mobile banking services. You can reset SC Mobile Key on a new phone to secure your account.

Does the Standard Chartered Mobile App have a minimum deposit requirement?

When opening a new account, some account types have minimum deposit requirements. You can check account details in the app, with amounts displayed in US dollars (USD) and calculated based on the day’s exchange rate.

Can I buy foreign currency with the Standard Chartered Mobile App?

You can buy and sell foreign currency anytime using the app. You’ll see the latest exchange rates instantly, and all transaction amounts are displayed in US dollars (USD), making it easy to manage foreign currency assets.

SC Mobile’s intuitive interface and 24/7 services streamline your banking, but cross-border investments and transfers demand more efficient solutions. BiyaPay enables US and Hong Kong stock investments without extra overseas accounts—start now at BiyaPay! With transfer fees as low as 0.5% and coverage across 190+ countries, it meets global funding needs. Real-time exchange rate queries simplify USD-HKD tracking, enhancing market quote monitoring.

Its 5.48% annualized yield wealth product offers flexible withdrawals to navigate volatility. Regulated internationally, it ensures secure transactions. Visit BiyaPay today to boost your financial efficiency!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.