What to Know About Cashback Safety Before You Sign Up

Image Source: unsplash

You may wonder if cashback websites are safe. Many platforms are legitimate, but you must watch for scams, data breaches, and privacy issues. The global cashback and rewards app market reached about USD 8.5 billion in 2023. Millions of people use these services, and the market keeps growing each year. Understanding cashback safety protects your personal information. Always choose trusted platforms and focus on fraud prevention. Strong fraud prevention habits help you avoid risks. Practice fraud prevention at every step. Fraud prevention is the key to cashback safety. Use fraud prevention to keep your data safe. Remember, fraud prevention works best when you stay alert. Rely on fraud prevention for every transaction. Make fraud prevention a habit for safer cashback experiences.

Key Takeaways

- Choose trusted cashback websites with strong security features like SSL encryption and two-factor authentication to protect your data.

- Use strong, unique passwords and regularly check your account activity to prevent fraud and keep your rewards safe.

- Be aware of common risks such as scams, data breaches, and privacy issues by reading reviews and understanding each site’s rules.

- Limit the personal information you share and adjust privacy settings to reduce exposure to data misuse and tracking.

- Stay alert for red flags like suspicious messages or offers that seem too good to be true, and report any unusual activity immediately.

How Cashback Websites Work

Image Source: pexels

Cashback websites help you earn cashback when you shop online. You join a cashback website or use cashback apps. You find a store you like, click the link, and shop as usual. The cashback website tracks your purchase. You get a percentage of your spending back as cash rewards. This process makes rewards-based websites popular for people who want to save money. Fraud prevention starts when you choose a trusted platform. Always check if the site uses fraud prevention tools to protect your data.

Earning Cashback

You earn cashback by following simple steps. First, sign up for a cashback website. Next, search for your favorite store. Click the store link on the site. Make your purchase. The cashback website records your transaction. After a short wait, you see your cashback in your account. Fraud prevention helps keep your earnings safe. Never share your password. Use strong passwords for extra fraud prevention. Some cashback apps offer daily, weekly, or monthly payouts. Fraud prevention works best when you check your account often.

Affiliate Marketing Basics

Cashback websites use affiliate marketing. Stores pay these sites a small fee for sending shoppers. The cashback website shares part of this fee with you as cashback. This system helps both stores and shoppers. Fraud prevention is important here. Reliable sites use fraud prevention to stop fake transactions. You should always read the terms and conditions. Some sites have rules about which purchases earn cashback. Fraud prevention also means checking for clear rules and fair payouts.

Note: Cashback mechanics differ between platforms. Some sites pay real cash, while others give bonus funds. Payouts can be daily, weekly, or monthly. Sites with clear rules and no hidden fees use strong fraud prevention. Confusing rules can lead to mistakes and lost rewards.

Reward Redemption

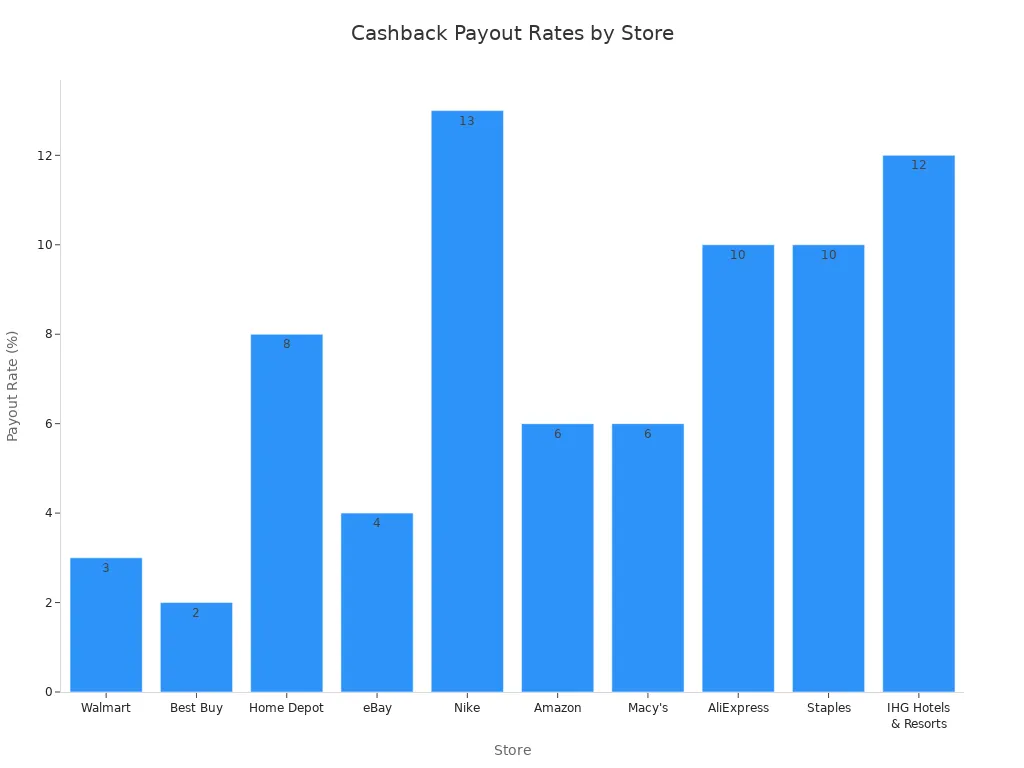

You can redeem your cash rewards in different ways. Most cashback websites let you transfer money to your bank account or get gift cards. Some sites have minimum payout amounts. Fraud prevention protects your payment details during redemption. Always use secure payment methods. Compare payout rates across stores to get the best value. Here is a table showing typical payout rates:

| Store (Example) | Typical Cashback Payout Rate |

|---|---|

| Walmart | Around 3% |

| Best Buy | Approximately 2% (up to 10%*) |

| Home Depot | Up to 8% ($15 value noted) |

| eBay | About 4% |

| Nike | Up to 13% |

| Amazon | Around 6% |

| Macy’s | Between 6% and 11%* |

| AliExpress | Around 10% |

| Staples | Up to 10% |

| IHG Hotels & Resorts | Approximately 12% |

Fraud prevention is key at every step. Always check for secure websites, strong passwords, and clear payout rules. Good fraud prevention habits help you enjoy cashback safely.

Are Cashback Websites Safe?

You may ask, “Are cashback websites safe?” Most platforms work hard to protect users, but some risks still exist. You need to know how to spot a legitimate website and avoid scams. Many cashback websites use strong fraud prevention tools to keep your information safe. You should always check a site before you sign up or make cashback transactions. Learning about company reputation, user reviews, and security features helps you make smart choices and improve cashback safety.

Company Reputation

Start by checking the reputation of any cashback website. Trusted brands have a long history and many happy users. You can look for awards, media mentions, or partnerships with big companies. A legitimate website will show clear contact details and company information. Fraud prevention works best when you choose sites with a good track record. If a site hides its address or has no customer support, you should stay away. Many trusted brands also use third-party audits to prove their honesty. This step adds another layer of fraud prevention.

User Reviews

User reviews give you real feedback from people who use cashback websites. You can find reviews on forums, social media, and review sites. Look for patterns in the comments. If many users complain about missing rewards or slow payments, you should be careful. Good reviews often mention fast payouts, easy use, and strong fraud prevention. Some fake reviews exist, so check for detailed stories and verified users. Reading both good and bad reviews helps you see the full picture. Fraud prevention means learning from others’ mistakes and successes.

Tip: Always read recent reviews. Cashback websites can change over time. New owners or updates may affect cashback security and fraud prevention.

Security Features

Security features protect your data and money during cashback transactions. Reputable cashback websites use SSL encryption to keep your information safe. Many sites also offer two-factor authentication, which adds another step to log in. These tools stop hackers and improve fraud prevention. You should look for these features before you sign up.

Here is a table showing common security features on popular platforms:

| Platform | Security Features Included | Additional Notes |

|---|---|---|

| Empire.io | SSL encryption, two-factor authentication (optional) | Robust security, 24/7 support, multi-language |

| Ybets Casino | SSL encryption, two-factor authentication | Licensed, responsible gambling tools |

| MetaWin | SSL encryption, regular security audits | Responsible gaming tools, self-exclusion options |

| 7Bit Casino | SSL encryption, secure payment processing | Licensed by Curacao Gaming Authority |

| Flush Casino | Licensed, secure platform, fairness audits | Responsible gambling tools |

Most trusted brands use SSL encryption and two-factor authentication as standard tools for fraud prevention. These features help protect your personal data and make cashback security stronger.

In some places, laws help protect users. For example, in the UK, the Information Commissioner’s Office says cashback tracking cookies are “strictly necessary” for cashback websites. This rule means sites do not need to ask for your consent before using these cookies. The rule makes it easier for you to use cashback websites and helps with fraud prevention. Other regions, like the United States, do not have the same rules yet. You should always check the privacy policy and fraud prevention steps on each site.

Fraud prevention should guide every step you take. Always check for clear privacy policies, secure payment methods, and strong login tools. If a site offers deals that seem too good to be true, use extra caution. Good cashback security comes from smart choices and careful research.

Cashback Safety Risks

Image Source: unsplash

Cashback safety depends on your awareness of the risks. You need to know how fraud prevention works at every step. Many users enjoy rewards, but some face problems that can affect cashback security. Below, you will learn about the most common risks and how to protect yourself.

Cashback Fraud

Fraud prevention is your first defense against cashback fraud. Some users try to cheat the system by making fake purchases or using multiple accounts. Cashback websites use fraud prevention tools to spot these tricks. If the system flags your account, you might face suspension or even lose your rewards. Sometimes, honest users get caught in these checks. You may see your account closed if the website suspects abuse, even if you did nothing wrong.

Common complaints include:

- Account suspensions after using the same IP address as someone else.

- No clear way to appeal or explain your situation.

- Delays when you send documents to prove your identity.

Websites often review flagged accounts and may escalate your claim to their partners. They might offer compensation if you prove your case. Still, you should always follow the rules and use fraud prevention habits to avoid trouble.

Data Breaches

Data breaches can expose your sensitive information. Cashback websites collect your name, email, payment details, and even your browsing activity. They store this data to track cashback transactions and process rewards. If hackers break into the system, your data could be at risk.

Fraud prevention includes using strong passwords and checking for secure websites. Look for SSL encryption and two-factor authentication. These tools help protect your data from cybercriminals. Some websites keep your data even after you close your account. You should read the privacy policy to understand how long they keep your information.

Tip: Use unique passwords for each cashback website. Change your password often to improve fraud prevention.

Privacy Concerns

Privacy concerns are a big part of cashback safety. Cashback websites share your data with affiliate partners, banks, and advertisers. They use your information for targeted marketing and to process your rewards.

Industry standards require websites to:

- Disclose affiliate relationships clearly.

- Follow data protection laws like those from the FTC in the US and the European Commission in the EU.

- Use honest marketing and fraud prevention practices.

- Monitor affiliates and act against noncompliance.

Websites like Rakuten collect data through apps, browser extensions, and third-party platforms. You can opt out of some data sharing, but you must take action yourself. Data may stay in their system even after you delete your account. Fraud prevention means reading privacy policies and limiting what you share.

Browser extensions can also create privacy risks. Some extensions ask for permissions that let them track your browsing, access cookies, and even inject scripts. These actions can collect your data without you knowing. Some extensions act like spyware and update their behavior to avoid detection. Fraud prevention means only installing trusted extensions and reviewing their permissions.

Cashback Traps

Cashback traps can hurt your wallet. Some users spend more than planned just to earn rewards. This behavior can lead to overspending and financial stress. Fraud prevention includes setting a budget and sticking to it.

Other traps include:

- Confusing rules that make it hard to earn or redeem rewards.

- Minimum payout amounts that delay your access to cash.

- Tracking failures caused by ad-blockers or browser extensions.

Websites may advise you to disable extensions, clear cookies, and finish purchases in one session. If you miss a step, you might lose your cashback. Fraud prevention means following best practices and reading all instructions before you shop.

Remember: Cashback safety and cashback security depend on your habits. Always use fraud prevention at every stage, from signing up to redeeming rewards. Protect your data, use strong passwords, and avoid risky behavior during cashback transactions.

Cashback Security Tips

Limiting Data Sharing

You can protect your personal information by limiting what you share with cashback websites. Fraud prevention starts when you sign up. Follow these steps to reduce your risk:

- Avoid signing up with social media accounts. This stops extra data from being shared.

- Only give the information the cashback site needs. If a site asks for more, use caution.

- Use strong, unique passwords for each cashback account.

- Check your privacy settings often. Tools like Bitdefender Digital Identity Protection can help you manage what you share.

- Watch your account activity. Report anything unusual right away.

- Pick cashback platforms with good reviews and a strong reputation.

- Think about using digital identity protection services. These can alert you to data breaches quickly.

Fraud prevention works best when you stay in control of your data.

Strong Passwords

Strong passwords are a key part of fraud prevention and cashback security. You should:

- Mix uppercase and lowercase letters, numbers, and special characters.

- Avoid common words, names, or easy patterns.

- Make passwords at least 12 characters long.

- Use a different password for each account.

- Change your passwords often.

- Store passwords in a trusted password manager.

These steps make it harder for criminals to break into your accounts. Fraud prevention depends on strong, unique passwords.

Recognizing Red Flags

Spotting red flags helps you avoid scams and protect your cashback security. Watch for these warning signs:

- Unsolicited emails or messages with spelling mistakes or odd requests.

- Pressure to act fast, like threats or urgent payment demands.

- Requests for payment by cryptocurrency, wire transfer, or gift cards.

- Social media contacts asking for personal details.

- Offers that seem too good to be true.

Tip: Always check the website address before entering your information. Research sellers and look for complaints. Fraud prevention means staying alert to red flags.

Reporting Issues

If you notice suspicious activity, take action right away. Fraud prevention includes reporting problems quickly. Here is what you should do:

- Watch your transactions and account behavior for anything odd.

- Write down details about the suspicious activity.

- Check if the issue meets the rules for reporting.

- File a report with the cashback platform or the right agency, like the FTC.

- Keep records of your report and any replies.

- Follow up to make sure your case is handled.

Note: Cashback should be a bonus, not a guarantee. Use fraud prevention to avoid impulse spending and protect your money.

You need to stay alert and make smart choices when using these platforms. Practicing fraud prevention helps you avoid scams and protect your information.

- Adjust privacy settings and use strong passwords for better fraud prevention.

- Enable two-factor authentication and use secure networks.

- Choose platforms with clear rules and reliable support.

- Always check if the website follows privacy policies.

- Make sure you understand how purchases are tracked and confirmed.

- Watch for delays in payments and read all terms.

By following these steps, you can enjoy rewards and keep your data safe.

FAQ

How do you know if a cashback website is legitimate?

Check for a clear privacy policy, secure website address (https), and strong customer support. Read recent user reviews. Look for well-known partners or awards. Trusted sites often show company details and contact information.

What should you do if your cashback does not appear?

First, check the website’s help section. Make sure you followed all steps. Contact customer support with your order details. Keep records of your purchase and communication. Some platforms may take several days to process rewards.

Can you use more than one cashback website for the same purchase?

You usually cannot combine multiple cashback sites for one order. Most stores only credit one referral per transaction. Here is a quick comparison:

| Cashback Site Used | Cashback Earned? |

|---|---|

| Only one | Yes |

| More than one | No |

Is it safe to link your bank account to a cashback website?

Only link your bank account if the site uses strong security, like SSL encryption and two-factor authentication. Choose platforms with a good reputation. You can also select payout options like PayPal or gift cards for extra safety.

Cashback platforms can be rewarding, but your earnings only matter if you can withdraw them safely and cost-effectively. Many users struggle with delays, hidden fees, or limited payout options.

With BiyaPay, you stay in control. The platform offers multi-currency and crypto–fiat conversion, transparent real-time FX rates, and ultra-low fees from 0.5%. Plus, you can enjoy same-day settlement across most regions, making it faster and safer to turn your rewards into spendable funds.

Don’t let payout risks reduce your cashback benefits — sign up for BiyaPay today and secure your earnings with confidence.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Focusing on AI and Semiconductors: In-Depth Analysis of 10 Leading Future US Tech Stocks

Master US Stock Trading Hours in One Article: Never Miss Pre-Market and After-Hours Opportunities

US Stock Market Holiday Countdown: How Investors Should Position for Next Week's Trading

Essential Apps for Getting Started with US Stock Futures: These Apps Will Turn You into a Pro

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.