2025 Must-Know for Investors: Complete Guide to the Shanghai A-Share Index

Image Source: unsplash

The Shanghai A-Share Index is a market benchmark that exclusively tracks the overall performance of all A-share stocks listed on the Shanghai Stock Exchange and denominated in RMB. For any investor seeking a deeper understanding of China’s stock market dynamics, mastering this index is essential. It provides a clear window into the overall health of the market and serves as an indispensable tool for analyzing trends.

Key Takeaways

- The Shanghai A-Share Index reflects the performance of all A-shares on the Shanghai Stock Exchange and is a vital indicator for understanding the Chinese stock market.

- It excludes financially troubled stocks and uses total market-cap weighting for a more accurate representation of market conditions.

- The Shanghai A-Share Index differs from the SSE Composite, CSI 300, and FTSE China A50 indexes, each with its own scope and purpose.

- Investors can track the index through ETFs, but must pay attention to China’s regulatory rules and RMB exchange-rate risk.

- Index movements are influenced by monetary policy, industrial policy, regulatory changes, and global conditions—careful assessment is required before investing.

What Is the Shanghai A-Share Index?

Image Source: unsplash

The Shanghai A-Share Index, officially coded SHA:000002, is a key benchmark measuring the overall performance of all A-share stocks listed on the Shanghai Stock Exchange. It acts as a mirror reflecting the rises, falls, and general sentiment of the Shanghai A-share market. To grasp the pulse of China’s stock market, one must start by understanding this index.

Index Component Selection

The Shanghai A-Share Index has a very broad selection principle—it aims to include all A-share stocks listed and traded on the Shanghai Stock Exchange. This means any company with A-shares listed in Shanghai is automatically included in the index sample.

Important Note A critical screening rule is that the index excludes stocks designated for “Special Treatment” (ST or *ST). These are marked as ST or *ST and indicate financial irregularities or other issues that raise delisting risk. Excluding them helps the index more accurately reflect the overall condition of normally operating companies.

Calculation Method

The index uses a weighted average method, with weights determined by each stock’s total market capitalization. It was launched with a base date of December 19, 1990, set at 100 points. All subsequent values are compared against that base period.

Its calculation formula is:

Index Value = (Total Market Cap of Components in Reporting Period ÷ Base Period Market Cap) × 100

Key elements include:

- Total market cap of components in the reporting period: The current aggregate market value of all component stocks.

- Total market cap: Calculated as

Share Price × Total Issued Shares. - Base period market cap: The total market cap of all components on December 19, 1990.

This formula ensures index changes precisely reflect fluctuations in overall market value.

Significance of the Index

The Shanghai A-Share Index is more than just a number—it is a vital market “thermometer.” Rising values generally indicate optimistic sentiment and increasing stock values across the board; falling values signal pessimism and shrinking valuations.

As a broad composite index, its movements are heavily influenced by higher-weighted sectors. Understanding sector composition helps investors identify the market’s primary drivers. As of early 2025, sector weightings show that cyclical sectors like finance and industrials dominate.

| Sector | Weight (as of Jan 1, 2025) |

|---|---|

| Financials & Real Estate | 27.4% |

| Industrials | 18.7% |

| Information Technology | 10.8% |

| Materials | 8.2% |

| Consumer Staples | 7.2% |

| Energy | 7.5% |

| Consumer Discretionary | 6.4% |

| Healthcare | 5.4% |

| Utilities | 4.8% |

| Communication Services | 3.6% |

As shown, financials and industrials together account for nearly half the index. Therefore, cyclical trends and policy changes in these sectors have a decisive impact on the overall Shanghai A-Share Index. Investors can forecast potential index direction by monitoring leading sectors.

Shanghai A-Share Index vs. Other Key Indexes

After understanding the Shanghai A-Share Index, investors often get confused by other major China market indexes. Each has different compilation rules and market representation. Clarifying these differences is the foundation for accurate market judgment. Below is a comparison of three key indexes to help investors build clear understanding.

Difference from SSE Composite Index

The SSE Composite Index (SHA:000001) is the most frequently quoted by media, but it differs fundamentally from the Shanghai A-Share Index.

- Shanghai A-Share Index: Includes only A-shares listed on the Shanghai Stock Exchange.

- SSE Composite Index: Includes all stocks listed on the Shanghai Stock Exchange—A-shares plus B-shares.

B-shares are denominated in USD or HKD and mainly traded by foreign investors. Since the B-share market is far smaller and less liquid than A-shares, the SSE Composite can occasionally be slightly affected by B-share movements. For those focused purely on RMB-denominated performance, the Shanghai A-Share Index is the cleaner benchmark.

| Index Name | Market | Stock Types Included | Primary Purpose |

|---|---|---|---|

| Shanghai A-Share Index | Shanghai Stock Exchange | A-shares only | Reflect overall performance of Shanghai A-shares |

| SSE Composite Index | Shanghai Stock Exchange | A-shares + B-shares | Reflect comprehensive performance of Shanghai market |

Difference from CSI 300 Index

The CSI 300 Index (SHA:000300) is another highly representative benchmark, but its positioning is completely different from the broad A-Share Index. The main differences lie in market coverage and selection method.

Core Concept The CSI 300 is a “component index” designed to reflect the performance of large-cap blue-chip stocks in China, not the entire market.

- Broader market coverage: The CSI 300 selects stocks from both Shanghai and Shenzhen exchanges, while the A-Share Index is limited to Shanghai only.

- Stricter selection criteria: It picks the largest and most liquid 300 companies from both markets. In contrast, the A-Share Index includes nearly all A-shares on the Shanghai exchange (excluding ST stocks).

In short, the CSI 300 is the “elite national team,” while the A-Share Index represents “full mobilization” of the Shanghai market alone. The former reflects China’s core corporate strength; the latter gives a comprehensive temperature reading of one exchange.

Difference from FTSE China A50 Index

The FTSE China A50 Index is compiled by the international index provider FTSE Russell. It was created specifically to give global investors a tool to track China’s largest A-share companies, so its logic differs markedly from the indexes above.

It selects the 50 largest A-share companies by market cap from both Shanghai and Shenzhen exchanges. It is regarded as the key gauge of China’s top-tier large-cap performance and underlies many international derivative products.

Its selection criteria are extremely strict to ensure high investability for global capital:

- Eligibility: Components must be accessible to international investors via Stock Connect programs.

- Market-cap ranking: Top 50 by total market cap among eligible stocks.

- Liquidity requirements: Strict daily trading volume standards.

- Investability: Considers foreign ownership limits to ensure openness to international funds.

- Risk exclusion: ST/*ST stocks are excluded, as with other indexes.

In summary, the FTSE China A50 is a highly concentrated, blue-chip-focused index tailor-made for international investors.

How to Invest in and Interpret the A-Share Index?

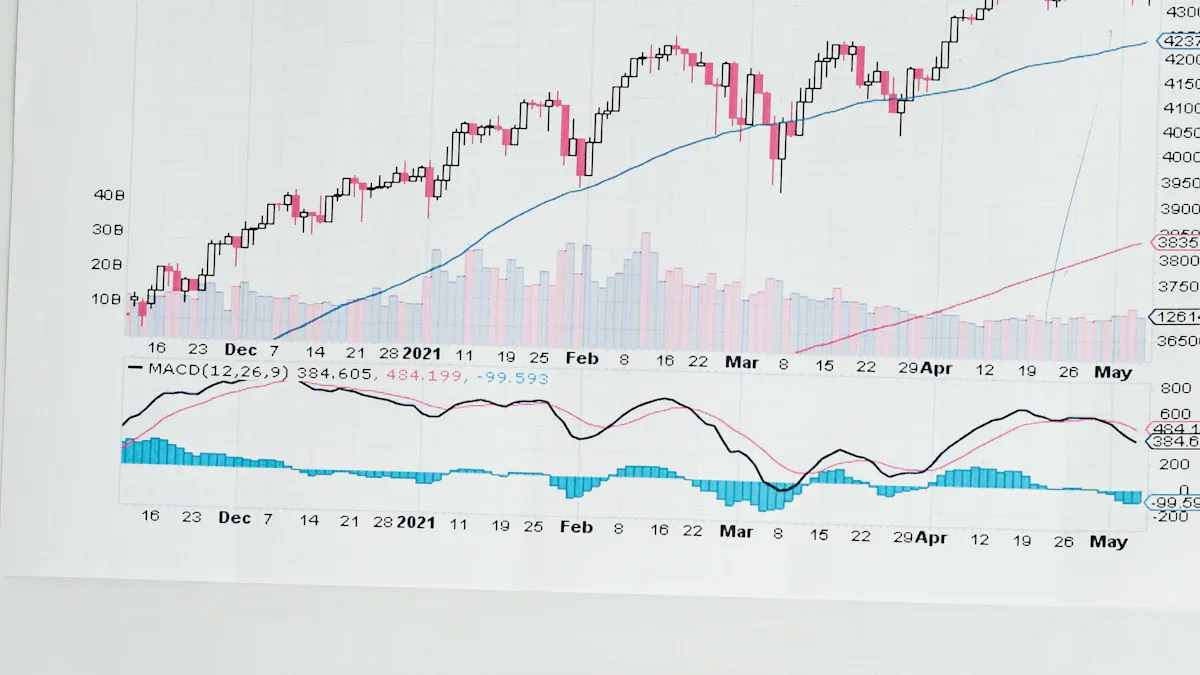

Image Source: pexels

After mastering the composition and comparison benchmarks of the Shanghai A-Share Index, the next step is learning how to interpret its market signals and explore practical investment channels. For international investors, understanding these real-world applications is key to turning theory into strategy.

Market Signals from Index Movements

Index rises and falls not only reflect sentiment but also directly embody economic and policy changes. Investors can interpret underlying signals from several angles:

- Monetary policy impact: PBOC actions such as interest rate or reserve ratio adjustments significantly affect the market. Historical data shows that easing measures like rate cuts typically boost stock prices.

- Industrial policy drivers: Government support for specific sectors—such as capital market opening or strategic emerging industries—can lift related sectors and push the overall index higher.

- Regulatory environment changes: Tighter or looser regulation directly affects investor confidence. For example, increased corporate controls or restricted data transparency can trigger market concerns and cause index declines.

- Global financial conditions: The international environment, especially Fed rate decisions, also impacts A-shares. Fed tightening can increase volatility and pressure index performance.

Investment Vehicles That Track the Index

For investors wanting exposure to the A-share market, buying every stock in the index individually is impractical. The most common and efficient way is through Exchange-Traded Funds (ETFs) that track the index. One ETF purchase gives exposure to a basket of stocks replicating the index performance.

Important Reminder International investors can access relevant ETFs listed on Shanghai or Shenzhen exchanges through brokers or institutions supporting the Stock Connect mechanism.

Here are some representative ETFs tracking major segments of the China A-share market:

| Code | ETF Name | Issuer |

|---|---|---|

| 563000 | E Fund MSCI China A50 Connect ETF | E Fund Management Co., Ltd |

| 510810 | Huatai-PineBridge SSE State-Owned Enterprises ETF | China Asset Management Co. |

| 560050 | ChinaAMC MSCI China A50 Connect ETF | China Asset Management Co. |

Key Considerations Before Investing

International investors must clearly understand the associated risks and regulations before committing capital. Regulation and currency are two unavoidable core factors.

- Regulatory compliance risk: Foreign investors must comply with China’s securities legal framework, including the Securities Law and Company Law. Additionally, the securities regulator in the investor’s home jurisdiction must have signed a regulatory cooperation MOU with the CSRC; otherwise, an A-share account cannot be opened.

- RMB exchange-rate risk: A-shares are denominated in RMB. Non-RMB investors must convert currency both when investing and redeeming. RMB fluctuations can create additional gains or losses, and currency conversion incurs transaction costs.

In summary, the Shanghai A-Share Index is the key benchmark measuring the overall performance of all A-shares on the Shanghai Stock Exchange. It serves not only as a “thermometer” for judging China stock market health but also as a “roadmap” for investing through ETFs and similar vehicles.

2025 Market Outlook Looking ahead, major institutions highlight key areas to watch:

- Morgan Stanley recommends long-term focus on China’s high-tech sectors such as AI and advanced manufacturing.

- UBS Securities expects growth stocks to outperform value stocks in the medium term.

Incorporating this index knowledge and market views into your analytical framework will help you make more comprehensive investment decisions.

FAQ

Which is more important—the A-Share Index or the SSE Composite?

Both serve different purposes. The SSE Composite is more frequently quoted by media because it includes B-shares and reflects the broader Shanghai market. For investors focused purely on RMB-denominated performance, the Shanghai A-Share Index is the cleaner indicator.

Does investing in the A-Share Index mean investing in the entire China stock market?

No. The Shanghai A-Share Index only represents A-shares on the Shanghai Stock Exchange. It excludes stocks listed on the Shenzhen Stock Exchange, so it reflects only part—not all—of the China market.

Why are some Shanghai-listed stocks not included in the A-Share Index?

The Shanghai A-Share Index excludes stocks under “Special Treatment” (marked ST or *ST), which indicate financial distress. Removing them helps the index reflect the overall condition of normally operating companies.

Can international investors directly trade the A-Share Index?

The index itself is a statistical figure and cannot be traded directly. International investors can gain exposure through financial products that track the index or related markets, such as Exchange-Traded Funds (ETFs).

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Say Goodbye to Panic: Master the Winning Rules for Stock Investing in a Bear Market

Say Goodbye to Bank Queues: Latest 2025 Bank of China App Guide for Converting Cash to Exchange

Want to Invest in the Chinese Stock Market? Start by Understanding the Shanghai Composite Index

After Over 100 Billion in Buybacks, Has Tencent's Long-Term Investment Logic Changed?

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.