Overcoming Human Weaknesses: Detailed Guide to Beginner-Friendly Automated US Stock Trading Strategies

Image Source: pexels

Have you ever chased highs on impulse or sold in panic during market fear? Quantitative trading is not an exclusive tool for financial elites. It can help you overcome these common human weaknesses. The core advantage of automated strategies lies in their strict discipline. They calmly execute trades based on preset rules and systematically analyze the market, thereby avoiding emotional decisions. This approach is particularly effective in US stock analysis, enabling timely capture of trading signals.

Did you know? The trend of individual investors participating in quantitative trading is growing rapidly. Data shows that North America was the highest-revenue market in 2024.

| Metric | Data |

|---|---|

| 2024 Market Revenue | $3.5528 billion |

| 2030 Market Revenue Forecast | $7.1752 billion |

| Compound Annual Growth Rate (2025-2030) | 12.7% |

Key Takeaways

- Automated trading helps you overcome emotions by trading based on rules.

- The dual moving average strategy uses two moving averages to identify market trends.

- The mean reversion strategy utilizes Bollinger Bands to capture price fluctuations.

- The ETF momentum rotation strategy selects the best-performing ETFs and is suitable for long-term investment.

- You need to choose the right trading platform, learn basic programming, and obtain high-quality data.

Dual Moving Average Strategy: Entry-Level Trend Following

Image Source: pexels

The dual moving average strategy is one of the most classic and intuitive methods in trend following. It helps you identify and follow the main market direction, avoiding frequent trading in ranging markets. The core of this strategy lies in using two moving averages (Moving Average, MA) with different periods to determine trends.

Strategy Core Logic

A moving average represents the average closing price over a past period. The dual moving average strategy typically uses a short-term MA (such as the 50-day line) and a long-term MA (such as the 200-day line).

- Golden Cross: When the short-term MA crosses above the long-term MA from below, it forms a golden cross. This is a bullish signal, indicating that market momentum may turn positive and foreshadowing the start of an uptrend. You can treat it as a buy signal.

- Death Cross: When the short-term MA crosses below the long-term MA from above, it forms a death cross. This is a bearish signal, indicating that the recent trend is weaker than the long-term trend and foreshadowing a downtrend. You can treat it as a sell or close position signal.

- Early Trend Phase: Before the golden cross appears, the price is usually in a downtrend, with the short-term MA below the long-term MA.

- Crossover Phase: The short-term MA crosses upward through the long-term MA, forming the buy signal point.

- Late Trend Phase: After crossover confirmation, the short-term MA continues running above the long-term MA, supporting price increases.

Automation Implementation Path

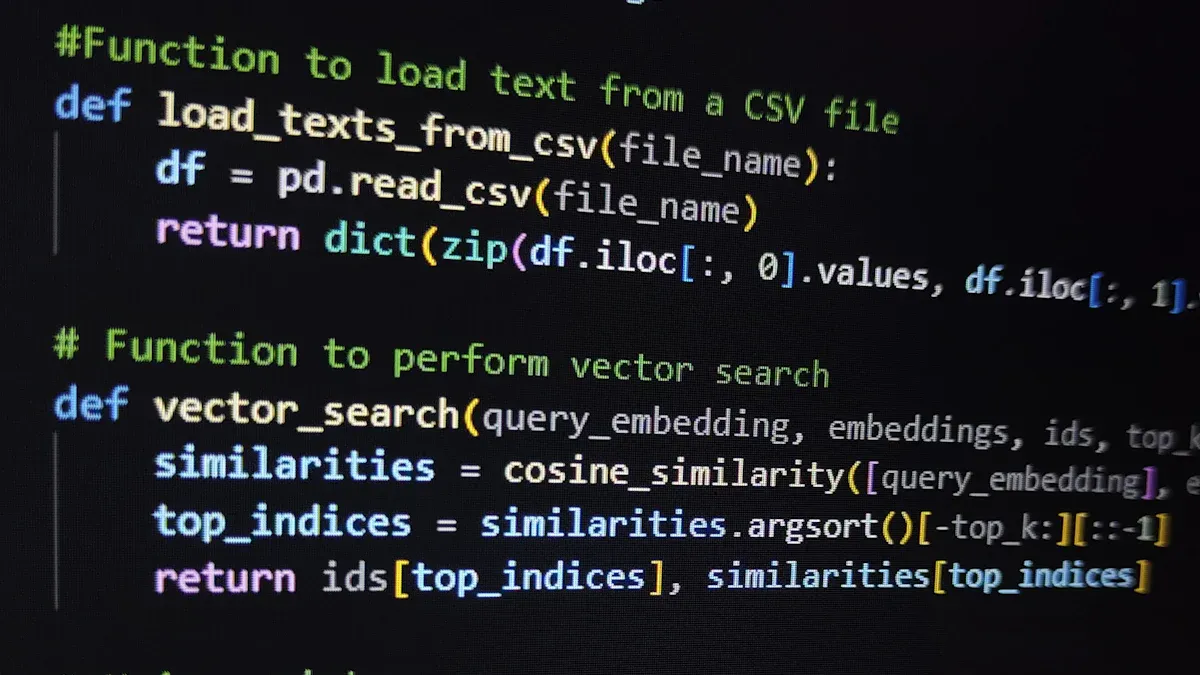

You can automate this strategy using the TradingView platform. With its built-in Pine Script language, you can easily write strategy logic and create alerts.

First, you need to write a simple script to identify golden and death crosses.

// @version

=5

indicator(“Dual Moving Average Crossover Strategy”, overlay=true)// Define MA periods

shortMA = ta.sma(close, 50)

longMA = ta.sma(close, 200)// Identify crossover signals

goldenCross = ta.crossover(shortMA, longMA)

deathCross = ta.crossunder(shortMA, longMA)// Mark signals on the chart

plotshape(goldenCross, style=shape.triangleup, location=location.belowbar, color=color.green, size=size.small)

plotshape(deathCross, style=shape.triangledown, location=location.abovebar, color=color.red, size=size.small)// Create alert conditions

alertcondition(goldenCross, title=“Golden Cross Buy Signal”, message=“Golden cross appeared, execute buy”)

alertcondition(deathCross, title=“Death Cross Sell Signal”, message=“Death cross appeared, execute sell”)

After writing the script, you can create alerts in the TradingView chart interface. When the alertcondition is triggered, the alert will be sent via Webhook to your broker’s API, automatically executing trades. Brokers supporting API trading include Interactive Brokers (IBKR) and TD Ameritrade, among others.

Historical Data Backtesting

Backtesting is crucial before committing real capital. You can apply the above script to historical candlestick charts of stocks you are interested in, such as the S&P 500 ETF (SPY) or Apple Inc. (AAPL).

Through backtesting, you will clearly see the historical positions of each golden and death cross signal, as well as the potential profits or losses from following those signals. This intuitive US stock analysis method helps you evaluate the strategy’s effectiveness.

Important Reminder Backtesting results allow you to understand the strategy’s performance in past market conditions. However, remember that history does not simply repeat itself. The dual moving average strategy performs better in markets with clear trends but may generate multiple false signals in prolonged ranging markets.

Mean Reversion Strategy: Capturing Price Fluctuations

If the dual moving average strategy is about “going with the trend,” then the core idea of the mean reversion strategy is “things will reverse when they reach an extreme.” It assumes that after a stock price deviates from its average in the short term, it tends to revert to the mean. This strategy is particularly suitable for capturing short-term profit opportunities in ranging markets with large price fluctuations but no clear unidirectional trend.

Strategy Core Logic

The most commonly used tool for implementing mean reversion is Bollinger Bands. It consists of three lines that clearly define relative high and low price levels.

- Middle Band: Usually the 20-day simple moving average (SMA).

- Upper Band: Middle band + 2 standard deviations.

- Lower Band: Middle band - 2 standard deviations.

Trading Signal Interpretation When the price touches or falls below the lower band, it indicates the stock may be oversold with potential to rebound to the middle band—this is a potential buy signal. Conversely, when the price touches or breaks above the upper band, it indicates the stock may be overbought with potential for a pullback—this is a potential sell signal.

The essence of this strategy is counter-trend trading at statistical boundaries, belonging to typical left-side trading.

Automated Trading Setup

You can automate the mean reversion strategy in multiple ways. Many trading platforms offer bots specifically designed for this.

- Choose the Right Tools: Grid bots automatically buy low and sell high within a preset price range, perfectly fitting mean reversion logic. Additionally, signal bots can connect to your TradingView account and automatically execute trades via Webhook when alerts for price touching the Bollinger Bands upper or lower bands are triggered.

- Define Strategy Parameters: When setting up automation, you need to specify several key parameters, which are crucial in any US stock analysis tool.

Bollinger Band Period: The calculation period for Bollinger Bands (e.g., 20 days).Standard Deviation Multiplier: The multiplier for standard deviation (usually 2.0).Trade Size: The quantity for each trade.Stop Loss: Stop-loss price or points.Take Profit: Take-profit price or points (usually set near the middle band).

- Execute Trading Logic: The bot continuously monitors the price. Once the price falls below the lower band without a position, it automatically executes a buy order. When the price rises back to the middle or upper band, it executes a sell.

Key Risks and Controls

The biggest risk of the mean reversion strategy is strong unidirectional trends. In a bull market, prices may continue running along the upper band (called “Bollinger Band walking”), and selling here would miss significant gains. In a bear market, prices may continue falling along the lower band, leading to ongoing losses on buys.

Therefore, strict stop-losses are the lifeline of using this strategy.

- Middle Band Stop-Loss: A common practice is to use the middle band as the stop-loss level. For example, after buying at the lower band, if the price fails to rebound and instead breaks below the middle band, close the position immediately.

- Reverse Band-Outside Stop-Loss: A more conservative approach. After buying at the lower band, set the stop-loss a certain distance below the lower band. This allows more room for price fluctuation but requires tolerating larger potential losses.

- Fixed Stop-Loss: Set a fixed loss percentage or amount, such as exiting unconditionally when the loss reaches 2%.

Safety Tip Never use the mean reversion strategy without setting a stop-loss. It helps effectively control potentially large risks in trending markets.

ETF Momentum Rotation: Steady Long-Term Choice

Unlike strategies chasing short-term fluctuations, ETF momentum rotation is a steady approach focused on medium- to long-term horizons. Its core concept is very simple: “the strong get stronger, the weak get weaker.” You don’t need to predict the market; you just need to follow the momentum already formed.

Strategy Core Logic

This strategy requires you to first select an ETF investment pool, such as ETFs covering different sectors, countries, or asset classes. Then, you periodically review the performance of these ETFs over a past period, known as the “lookback period.”

How is momentum measured? The lookback period is key to calculating momentum. Different strategies use different time windows, with common choices including:

- 7 trading days

- 198 days

- 10 or 20 days (for calculating short-term performance)

The execution logic of the strategy is: buy and hold the strongest-performing ETFs during the lookback period while selling or avoiding the weakest. In this way, your capital is always concentrated in the assets with the strongest upward momentum.

Automated Rebalancing Methods

The essence of the momentum rotation strategy lies in disciplined “rebalancing.” Rebalancing frequency has a significant impact on final returns. Data shows that for long-term momentum strategies, monthly rebalancing typically yields higher returns than quarterly or annual.

| Strategy Name | Rebalancing Frequency | Total Return (Since 2003/2005/2008) |

|---|---|---|

| Momentum Investor | Monthly | +1,220.7% |

| Twin Momentum Strategy | Monthly | +2,105.8% |

| Quantitative Momentum Investor | Monthly | +1,001.6% |

Momentum is fleeting, and frequent rebalancing ensures your portfolio stays aligned with the strongest market trends. You can use brokers supporting APIs to write scripts that automate the entire process of ranking, calculation, and rebalancing.

Why It Suits Beginners

- Clear Rules, Goodbye Emotions: You only need to follow the simple rule of “buy the strong, sell the weak,” without complex US stock analysis or emotional decisions.

- Natural Diversification, Reduced Risk: The strategy invests in a basket of assets (ETFs) rather than individual stocks, effectively diversifying the risk of single-company blowups.

- Better Risk-Return Profile: Compared to simply buying and holding an index, ETF rotation strategies aim for higher returns and lower volatility. Especially during major market crashes like the 2008 financial crisis, such strategies demonstrated excellent risk control by shifting to safe-haven assets like bonds.

Quantitative Tools and Basic US Stock Analysis

Image Source: unsplash

With strategies in hand, you also need the right tools to achieve automation. Choosing the correct platform and mastering basic skills are key to successfully starting your quantitative trading journey. This is not only about execution but also the foundation for effective US stock analysis.

Trading Platform Selection

Choosing a suitable trading platform is your first step. You need to focus on its API reliability, available instruments, and fees. Brokers supporting API trading are a prerequisite for automation.

What is API Trading? API (Application Programming Interface) allows your programs to communicate directly with the broker’s system, automatically sending buy/sell orders without manual operation.

TD Ameritrade and Alpaca are two common choices. You can fund these accounts conveniently using crypto-friendly payment tools like Biyapay.

| Feature | TD Ameritrade | Alpaca |

|---|---|---|

| Broker Type | Discount | API-Only |

| Stock and ETF Commissions | No fees | No fees |

| Fractional Shares | No | Yes |

| Options Trading | Yes | No |

| Options Fees | $0.60 | N/A |

| API Trading | Yes | Yes |

| New Account Minimum | $0 | $0 |

Essential Programming Basics

While you don’t need to become an expert programmer, mastering some programming basics will give you a significant advantage. Python is the preferred language in quantitative finance, thanks to its powerful third-party library support.

You need to be familiar with the following key Python libraries:

- Data Processing: Pandas and NumPy for efficient handling of financial data.

- Technical Analysis: TA-Lib for calculating various technical indicators.

- Strategy Testing: Backtrader and Zipline for backtesting and validating trading strategies.

- Data Visualization: Matplotlib and Plotly for creating charts.

Recommended Free Learning Resources You can start with QuantEcon’s “Python Programming for Economics and Finance” lecture series or follow free Python algorithmic trading resources from PyQuant News.

Data Acquisition and Processing

High-quality data is the lifeline of quantitative trading. You need reliable data sources for backtesting strategies and generating trading signals.

You can obtain data via APIs. Some services offer free tiers suitable for beginners.

| API Name | Type | Main Features |

|---|---|---|

| Alpha Vantage | Free and Paid | Provides real-time and historical financial market data with broad coverage. |

| Marketstack | Free and Paid | Free plan offers 100 requests per month, includes after-hours data. |

| EODHD | Paid (with free trial) | Provides historical stock prices and fundamental financial data. |

After acquiring data, you also need to clean it. Due to corporate actions like stock splits, raw price data may have inconsistencies. You must adjust historical prices to ensure continuity. At the same time, handling missing values is an important step, with common methods including:

- Forward/Backward Fill: Fill missing values with the previous or next data point.

- Interpolation: Calculate and fill missing values based on surrounding data points.

- Deletion: If the amount of missing data is small, directly delete the corresponding rows.

The dual moving average, mean reversion, and ETF rotation strategies introduced in this article are effective paths to start quantitative trading. Before committing real capital, be sure to follow the safest action guide:

Three-Step Principle: Backtest → Paper Trade → Small Real Capital

Backtesting lets you validate strategies with historical data, while paper trading tests execution in real market conditions, preparing you for live trading delays and emotional impacts. Many beginners fail due to ignoring risk management and emotional trading. Remember, prioritizing risk control and continuous learning and optimization is the long-term path.

FAQ

Does automated trading require keeping the computer on all the time?

No. You can use cloud servers (VPS) or trading platforms that support cloud execution. This way, your strategies can run 24 hours uninterrupted without occupying your personal computer resources.

How much capital should a beginner start with?

It is recommended to start with small amounts. First familiarize yourself with the process through paper trading, then use real capital that won’t affect your life even if lost. This helps better manage risk and mindset.

Can strategies suddenly fail?

Any strategy can fail in specific market environments. Markets are dynamically changing, and no strategy works forever. Therefore, you need to regularly backtest and evaluate strategy performance and be prepared to adjust at any time.

Can I do automated trading without any programming knowledge?

Yes. Many trading platforms offer no-coding automation tools, such as grid bots or signal bots. You can directly use these tools to execute trading strategies based on preset conditions.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

In-Depth Analysis of US GDP: Comprehensive Insights from Consumption to Investment

US Stock Index Futures Trading Secrets: Master the Four Major Indices to Unlock Wealth Opportunities

A Blessing for Small Investors: Finding the Lowest Trading Cost US Stock Brokers

BiyaPay Secures Sumsub's Highest Security Certification: Building a Rock-Solid Foundation for a Global Integrated Financial Platform with Zero-Tolerance Risk Controls

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.