Introduction to Ria Money Transfer Service: An International Remittance Solution with Low Fees and Global Coverage

Image Source: unsplash

Have you ever been frustrated by the high costs and long waits of international remittances? Traditional bank transfers are not only cumbersome in process but also prohibitively expensive.

| Feature | Traditional Banks | Modern Remittance Solutions |

|---|---|---|

| Fees | Outgoing fees can reach $25-50 | Significantly lower fees |

| Processing Time | Up to 5 business days | Can be completed in as little as a few minutes |

Faced with these challenges, Ria Money Transfer provides a superior alternative. It is specifically designed to address these pain points, making your fund flows more efficient and economical.

Before comparing options, consider BiyaPay as a cross-border toolkit. It’s a multi-asset wallet supporting fiat–crypto conversion across payments, investing, and fund management.

To estimate costs upfront, use the free exchange-rate comparison tool to check live rates and expected proceeds by destination and amount.

For execution, its remittance service supports same-day transfers, fees as low as 0.5%, and coverage across most countries and regions.

BiyaPay also operates under multiple jurisdictions (e.g., US MSB and NZ FSP registrations), which helps reinforce compliance and trust for cross-border transfers.

Key Points

- Ria Money Transfer has low fees and transparent exchange rates, helping users save on international remittance costs.

- Ria has an extensive global network, supporting remittances to over 190 countries with diverse receiving methods.

- Ria uses advanced technology and strict verification to ensure the security of user funds and personal information.

- Ria is easy to operate; users can easily register, create transfer orders, and track transfer status.

Ria Money Transfer: A Globally Trusted Remittance Expert

Image Source: unsplash

When choosing a financial service, understanding its background and reputation is crucial. Ria Money Transfer is not just a modern platform but a global company with decades of industry experience, trusted by millions of users worldwide.

Company Background and Market Position

Ria was founded in 1987 and is headquartered in the United States. It started as a small store in New York City with the goal of helping people safely send money to their families. After more than thirty years of development, Ria has grown into one of the leaders in the global remittance industry. The company’s growth includes several important milestones:

- By 2012, Ria had become a leader in connecting the remittance market between the US and Mexico.

- In 2015, Ria acquired the well-known Malaysian remittance service provider IME, further expanding its influence in the Asian market.

These achievements demonstrate Ria’s continuous growth and market recognition worldwide, making it a reliable choice for personal and family remittances.

Global Compliance and Security Certifications

Fund security is the primary consideration for international remittances. Ria strictly complies with local financial regulations and supervisory requirements in every country it operates. It has obtained licenses and authorizations from financial regulatory bodies in multiple countries worldwide, including the US Treasury’s Financial Crimes Enforcement Network (FinCEN).

Security Tip: Choosing a government-regulated remittance service like Ria provides critical legal and security protection for your funds. This means your transactions are monitored to prevent fraud and illegal activities, ensuring your funds reach their destination safely.

By adhering to the highest compliance standards globally, Ria offers you a transparent and secure remittance environment.

Ria’s Core Advantages

When choosing among numerous remittance platforms, what truly matters is the core value of the service. Ria provides an efficient and reliable international remittance experience with its comprehensive advantages in fees, network, flexibility, and functionality.

Low Fees and Transparent Exchange Rates

One of the biggest pain points of international remittances is high costs. Ria is committed to saving you money on every transfer. Compared to traditional banks that often charge handling fees of $25 to $50, Ria’s fee structure is generally much lower.

More importantly, Ria maintains high transparency in exchange rates. It uses a retail exchange rate that includes a profit markup, but this mechanism is openly disclosed. This markup varies depending on the currency’s popularity, typically starting from 0.25% and reaching up to 4% for some less common currencies. This means you can see the final exchange rate and fees before the transaction, with no hidden costs. Ria clearly states this in its terms of service:

If you instruct us to pay the transfer to the recipient in a currency other than US dollars (“payout currency”), a retail exchange rate may apply, and your receipt will also show any service fees[…]. The difference between the retail exchange rate and the wholesale exchange rate we obtain for the payout currency will be retained by us and/or the payout agent as revenue, in addition to any service fees.

This transparency allows you to clearly understand where every part of your funds goes, enabling informed decisions.

Extensive Global Network

The value of a remittance service largely depends on its coverage. Ria excels in this area by combining advanced digital technology with a vast physical network. You can send funds through Ria to over 190 countries and regions worldwide.

Ria has over 500,000 cash pickup locations globally, meaning your recipient can conveniently collect cash at a nearby partner location even without a bank account. This extensive network ensures that no matter where your family or friends are, funds can be delivered safely and conveniently.

Diverse Payment and Receiving Methods

Flexibility is key in modern financial services. Ria Money Transfer fully considers the needs of different users, offering multiple options for both senders and recipients.

As a sender, you can easily pay through the following methods:

- Bank account

- Credit card

- Debit card

For recipients, Ria provides even more diverse receiving methods to adapt to lifestyles in different countries and regions:

- Bank Deposit: Funds are directly deposited into the recipient’s bank account, safe and fast.

- Cash Pickup: Recipients can collect cash at any Ria location with valid ID and a PIN.

- Mobile Wallet: Funds are sent directly to the recipient’s e-wallet account, convenient for mobile payments.

- Home Delivery: In some countries, Ria even offers cash delivered directly to the door, providing great convenience for recipients with limited mobility.

These rich options ensure your remittance reaches the recipient in the most suitable way.

Rich Features and Services

Ria is not just a remittance tool; it is a multifunctional financial service platform. In addition to core remittance services, Ria offers a range of practical additional services to make your cross-border financial life more convenient.

For example, in the US, you can use Ria’s platform to pay various bills. Whether it’s utilities, credit card bills, or fees from major providers like AT&T or Comcast, you can easily complete payments through Ria. This feature integrates your local bill payments with international fund management, greatly enhancing the platform’s practical value.

Ria’s Security Mechanisms

When conducting international remittances, fund security is your primary concern. Ria understands this and has established a comprehensive security mechanism. This system protects your funds and personal information across technology, processes, and compliance.

Data Encryption and Privacy Protection

The security of your personal information is critical. Ria uses advanced encryption technology to ensure all data you submit during remittances is properly protected, preventing unauthorized access.

At the same time, Ria maintains high transparency in its data-sharing policies. To provide services and comply with regulations, Ria may need to share your information with specific types of third parties. The table below clearly lists the details of data sharing, giving you a clear understanding of where your information goes:

| Recipient Category | Types of Personal Data Shared | Purpose of Sharing |

|---|---|---|

| Euronet Group | Identity, transaction, financial data, etc. | Daily business operations and compliance |

| Third-Party Service Providers | Identity, contact information, financial data, etc. | Identity verification, fraud prevention, advertising |

| Legal and Regulatory Authorities | Identity, transaction, financial data, etc. | Compliance with legal requirements |

| Strategic and Professional Partners | Identity, transaction, financial data, etc. | Providing services and fulfilling legal obligations |

Strict Identity Verification

To ensure only you can operate your account, Ria implements a strict identity verification (KYC) process. When creating an account or making large remittances, the system will require you to provide proof of identity. This typically includes:

- A valid government-issued ID, such as a passport or driver’s license.

- In some cases, additional documents like proof of address may be required.

This step is a key defense in protecting your account security, effectively preventing fraudsters from using your identity.

Global Anti-Money Laundering Compliance

As a global financial institution, Ria strictly complies with international anti-money laundering (AML) and counter-terrorism financing regulations. This means Ria monitors all transactions to identify and stop any suspicious illegal activities. To fulfill these legal obligations, Ria reserves the following rights:

Ria may refuse to process a remittance transaction under applicable law, especially if there is suspicion that the transaction may involve fraud or illegal activity. If you fail to provide sufficient and reliable proof of identity, Ria also has the right to refuse to process your transaction.

Therefore, you may encounter daily or per-transaction remittance limits, which are necessary measures to comply with global financial security standards.

Professional Fraud Prevention Team

In addition to automated monitoring systems, Ria has a professional fraud prevention team. This team is responsible for real-time review of suspicious transactions and proactively identifying potential fraud patterns. When they detect abnormal activity, they take immediate action to protect your funds from loss, providing an additional layer of security.

Ria Remittance Operation Guide

Image Source: unsplash

After understanding Ria’s advantages and security measures, you might wonder if it’s easy to operate. The answer is yes. Ria Money Transfer is designed to simplify the international remittance process. Below, we will guide you step-by-step on how to complete a remittance easily.

Registration and Verification

The first step to using Ria is creating a free account. You can do this through Ria’s official website or mobile app. Typically, you only need to provide basic personal information, such as your name, email address, and set a secure password.

After completing basic registration, to ensure your account and fund security, you need to undergo identity verification. This process is also known as “Know Your Customer” (KYC).

Security First: Identity verification is a key step in preventing fraud and complying with global financial regulations. It ensures that only you can operate your account, providing solid protection for your fund security.

You need to prepare the following documents to complete verification:

- Proof of Identity: A valid government-issued ID, such as your passport or driver’s license.

- Proof of Address: In some cases, the system may require documents proving your current residential address, such as a recent utility bill.

After submitting the documents, Ria’s team will review them. Once approved, your account will be activated, and you will receive the corresponding remittance limit.

Creating a Transfer Order

Once your account is ready, initiating a remittance is very simple. The entire process is clear and transparent, giving you full control over all details.

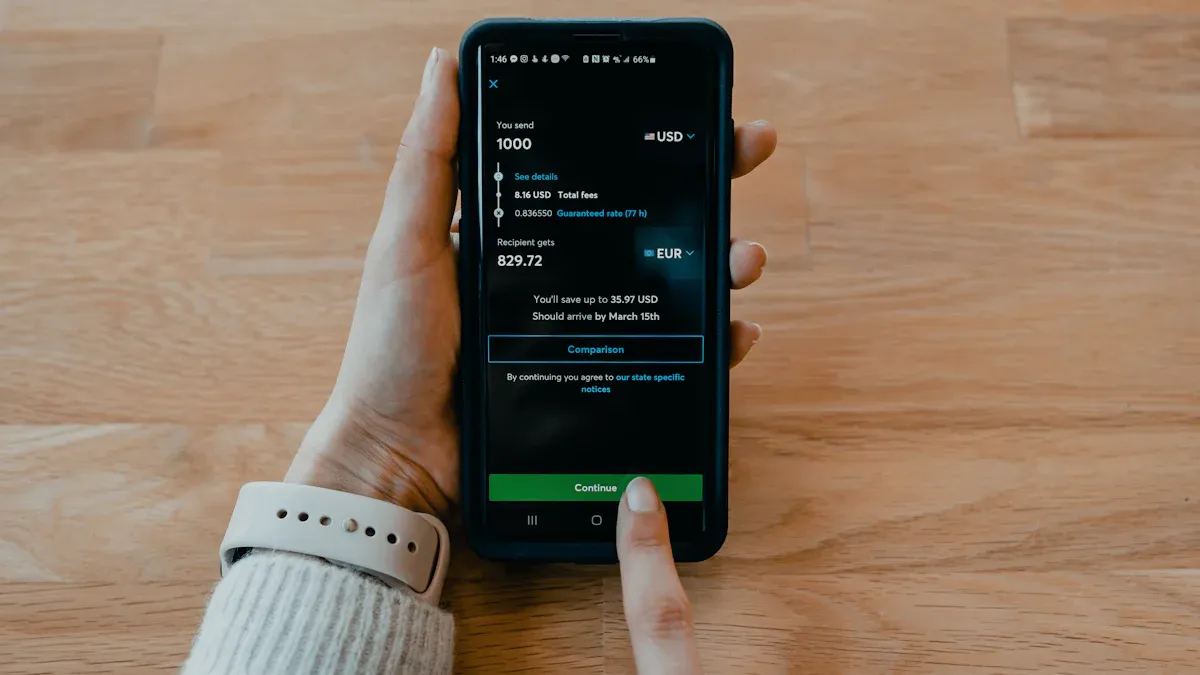

- Enter Remittance Information: First, select the destination country for your remittance and enter the amount you wish to send.

- Calculate Final Amount: Before confirming the transaction, Ria provides a clear fee calculator. You can see the real-time exchange rate, handling fee, and the exact amount the recipient will receive. This feature allows you to fully control costs and avoid any hidden fees.

- Fill in Recipient Details: Accurately entering the recipient’s information is crucial. The required information varies depending on the chosen receiving method.

- Bank Deposit: Requires the recipient’s full name, bank name, account number, etc.

- Cash Pickup: Usually only requires the recipient’s legal full name (must match ID) and contact phone number.

- Choose Payment Method: Select the most convenient method from your bank account, debit card, or credit card to pay for this remittance.

- Review and Confirm: In the final step, carefully check all information, including the recipient’s name, remittance amount, and receiving method. Once confirmed correct, submit your transfer order.

Tracking and Completion

After submitting the remittance, your main concern is the status of the funds. Ria provides powerful order tracking functionality, allowing you to check the latest status of your remittance at any time.

After successfully creating a transfer order, the system generates a unique order number or PIN. This number is key to tracking your remittance.

| Tracking Tool | Purpose |

|---|---|

| Order Number/PIN | Enter this number on the tracking page of Ria’s website or app to view the real-time status of the remittance. |

You can share this tracking number with the recipient. When the remittance status updates to “available for pickup” or “deposited,” the recipient can go to the designated location with valid ID and PIN to collect cash or check the deposit in their bank account. The entire process is transparent and efficient, giving you and your family peace of mind.

Ria Money Transfer integrates low costs, wide coverage, high security, and ease of operation. It helps you save valuable time and money, making it an ideal choice for family support or personal remittances. Download the Ria app or visit the official website now to start your first efficient remittance experience!

Exclusive Benefits for New Users

- First transfer enjoys a fee-free promotion.

- After completing your first remittance, you can also receive a $10 welcome bonus.

FAQ

How long does a remittance usually take?

Remittance speed depends on the chosen payment and receiving methods.

- Credit or Debit Card Payment: Funds can arrive in as little as a few minutes.

- Bank Account Payment: Processing may take up to 4 business days.

You can track the remittance status at any time using the order number.

Does Ria have remittance amount limits?

Yes, Ria has remittance limits to comply with regulations. You can send up to $2,999.99 within 24 hours, with a cumulative limit of $7,999 within 30 days. These restrictions help protect your account security and prevent illegal activities.

What should I do if my remittance encounters a problem?

If your remittance encounters any issues, you can immediately contact Ria’s customer service team.

You can get help via phone, email, or online chat. Please have your order number ready so customer service can quickly query and resolve the issue for you.

Does Ria support remittances to Mainland China?

Yes, you can use Ria to send remittances to Mainland China. Recipients can receive funds via bank deposit. When creating a transfer order, simply select China as the destination country and fill in the recipient’s bank account information.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Ultimate Guide to Applying for a Schengen Visa in the USA in 2025: Understand the Process, Documents, and Timeline in One Article

2025 Taiwan Stock Market Year-End Review and 2026 Outlook: Can the AI Boom Continue?

Want to Invest in the Chinese Stock Market? Start by Understanding the Shanghai Composite Index

2026 China Stock Market Investment Guide: Spotlight on 5 Must-Watch Leading Tech Stocks

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.