Analyzing On Holding AG Stock Performance and Forecasts for 2025

Image Source: pexels

When evaluating an investment like onon stock, you need to consider multiple factors. Financial performance, growth projections, and market valuation all play critical roles in determining its potential. As an investor, understanding these elements helps you make informed decisions. Does On Holding AG possess the financial strength to sustain its growth? Are analysts optimistic about its earnings trajectory? These are the questions you must answer to assess whether this stock aligns with your 2025 investment goals.

Key Takeaways

- On Holding AG’s revenue is growing fast and may hit $2,962 million by 2025, showing strong demand.

- Experts think ONON stock is a good buy, with an average price target of $58.77, meaning it could bring good profits.

- Investors should watch numbers like net profit margin and cash flow to check how well On Holding is doing financially.

- Problems like supply chain issues and higher prices might hurt profits, so staying updated on these is important.

- The company’s focus on eco-friendly products and selling directly to customers could help it grow in new markets.

Recent Financials of On Holding AG

Image Source: pexels

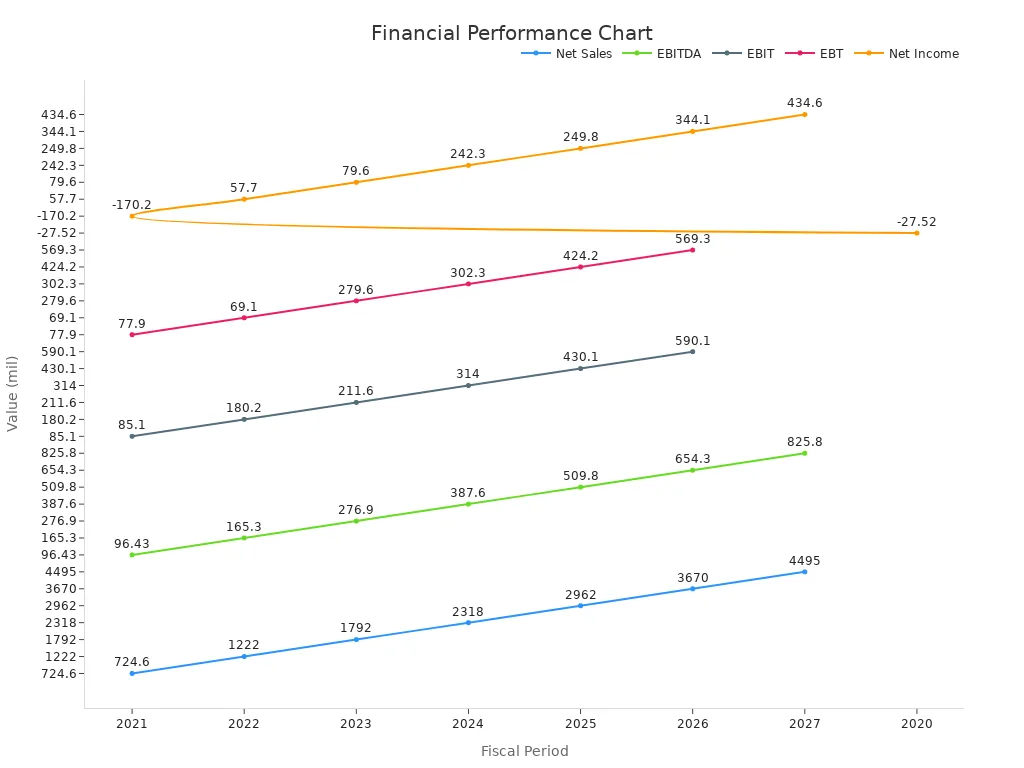

Revenue Growth and Earnings Trends

On Holding has demonstrated remarkable growth in its revenue over recent years. The company’s financials reveal a consistent upward trajectory, with net sales increasing from $724.6 million in 2021 to $1,792 million in 2023. This growth reflects the brand’s expanding market presence and strong consumer demand for its products. By 2025, projections indicate net sales could reach $2,962 million, showcasing the company’s ability to scale operations effectively.

The table below highlights On Holding’s key financial performance metrics over the years:

| Fiscal Period | Net Sales | EBITDA | EBIT | Earnings before Tax (EBT) | Net Income |

|---|---|---|---|---|---|

| 2020 | - | - | -141.1 | -159.6 | -27.52 |

| 2021 | 724.6 | 96.43 | 85.1 | 77.9 | -170.2 |

| 2022 | 1,222 | 165.3 | 180.2 | 69.1 | 57.7 |

| 2023 | 1,792 | 276.9 | 211.6 | 279.6 | 79.6 |

| 2024 | 2,318 | 387.6 | 314 | 302.3 | 242.3 |

| 2025 | 2,962 | 509.8 | 430.1 | 424.2 | 249.8 |

| 2026 | 3,670 | 654.3 | 590.1 | 569.3 | 344.1 |

| 2027 | 4,495 | 825.8 | - | - | 434.6 |

This consistent revenue growth underscores On Holding’s ability to capitalize on its innovative product offerings and global expansion strategies. The company’s earnings before interest and taxes (EBIT) have also shown steady improvement, rising from $85.1 million in 2021 to $211.6 million in 2023, with further growth expected in the coming years.

Historical Earnings Surprises

Earnings surprises can significantly impact investor sentiment and stock performance. On Holding’s historical earnings data reveal instances where actual results deviated from analyst expectations. For example:

- SurgePays, Inc. was expected to report a loss of $0.27 per share but actually reported a loss of $0.93, resulting in a surprise of -244.44%.

- Performance Food Group was expected to earn $1.03 per share but reported earnings of $0.98, leading to a surprise of -4.85%.

While these examples highlight the potential for earnings volatility, On Holding has generally maintained a stable earnings trajectory. The company’s ability to meet or exceed expectations in the future will likely depend on its operational efficiency and market adaptability.

Key Financial Metrics

To evaluate On Holding’s financial health, you should consider several key metrics:

| Metric | Description |

|---|---|

| Net Profit Margin | Indicates how much of each dollar in revenue remains as profit after expenses. |

| Return on Investment (ROI) | Calculates the profitability of an investment relative to its cost. |

| Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) | Provides insight into operating profitability before accounting for financing and non-cash expenses. |

| Current Ratio | Measures a company’s ability to cover short-term liabilities with short-term assets. |

| Debt-to-Equity Ratio | Evaluates financial leverage and capital structure. |

| Cash Flow from Operations | Tracks cash generated from business operations, excluding financing and investing activities. |

These metrics provide a comprehensive view of On Holding’s financial stability and operational efficiency. For instance, a strong net profit margin and positive cash flow from operations indicate the company’s ability to generate sustainable earnings. Additionally, a healthy current ratio and manageable debt-to-equity ratio suggest that On Holding is well-positioned to meet its financial obligations while pursuing growth opportunities.

Forecast for ONON Stock in 2025

Projected Revenue and Earnings Growth

On Holding has consistently demonstrated strong financial performance, and its future projections suggest continued growth. Analysts expect the company’s revenue to climb from $2,318 million in 2024 to $2,962 million in 2025, reflecting a robust revenue growth forecast. This increase highlights the brand’s ability to expand its market share and capitalize on consumer demand for its innovative products. The projected income statement also indicates a rise in net income, with estimates reaching $249.8 million in 2025, up from $242.3 million in 2024.

Earnings expectations for On Holding remain optimistic. The company’s EBITDA is forecasted to grow from $387.6 million in 2024 to $509.8 million in 2025, showcasing its operational efficiency. This growth aligns with the broader industry trend of increasing profitability among premium athletic footwear brands. However, achieving these targets will require On Holding to maintain its competitive edge and adapt to evolving market conditions.

Quantitative data underscores the importance of accurate forecasting. Studies reveal that 67% of organizations lack a formalized approach to forecasting, which can lead to missed growth opportunities and decreased stock value. By leveraging data-driven methods and cross-department collaboration, On Holding can enhance its forecast accuracy and sustain its upward trajectory.

Expected Changes in Balance Sheet and Cash Flow

On Holding’s balance sheet and cash flow forecast for 2025 suggest a stable financial position. The company is expected to maintain a healthy current ratio, ensuring its ability to meet short-term obligations. Additionally, its debt-to-equity ratio indicates manageable financial leverage, which supports long-term growth initiatives.

Cash flow projections play a crucial role in assessing On Holding’s financial health. These forecasts estimate future cash inflows and outflows, enabling the company to plan effectively and avoid potential financial challenges. For instance, cash flow forecasting helps anticipate liquidity needs, identify potential shortfalls, and guide investment decisions. Regular updates to these projections can prevent financial crises and ensure operational stability.

The table below outlines key types of forecasting that contribute to On Holding’s financial planning:

| Type of Forecasting | Description |

|---|---|

| Sales Forecasting | Projects future revenue based on historical data and market trends, aiding in inventory and staffing planning. |

| Cash Flow Forecasting | Predicts cash inflows and outflows, ensuring liquidity for operations and identifying potential shortfalls. |

| Historical Forecasting | Uses past performance data to predict future outcomes, assuming similar patterns will continue. |

| Budget Forecasting | Combines projected revenues with anticipated expenses to create a balanced financial plan. |

By focusing on these forecasting methods, On Holding can strengthen its financial foundation and support its ambitious growth targets.

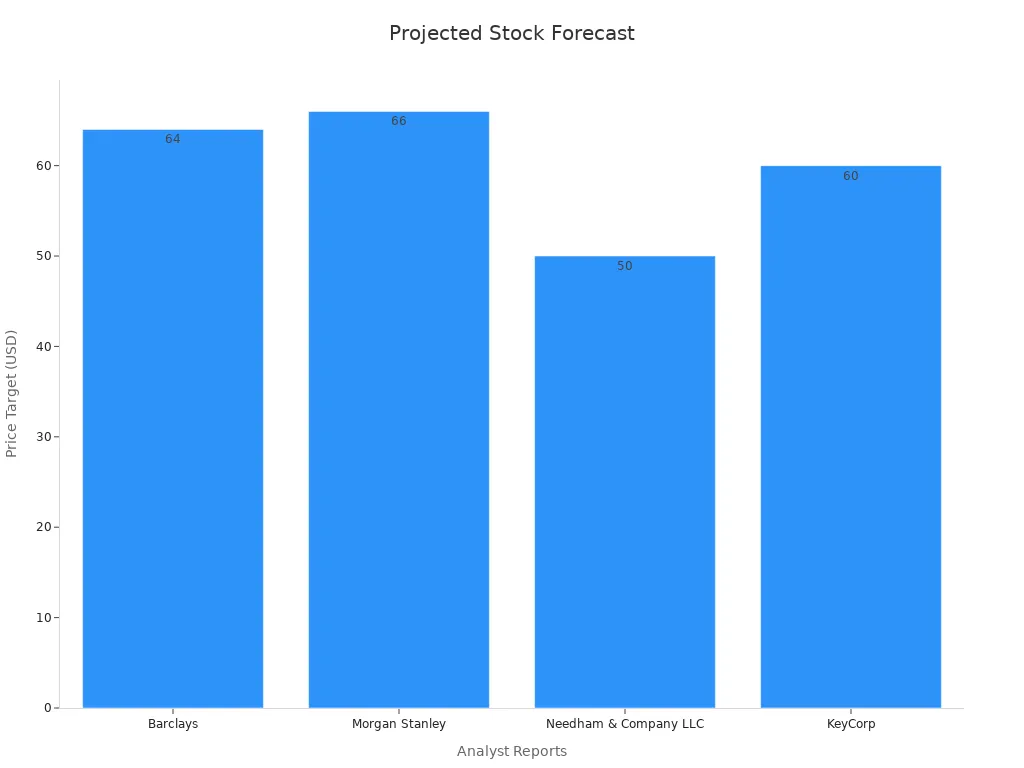

Analyst Consensus and Earnings Estimates

Analysts remain bullish on On Holding’s stock, with a consensus rating of “Buy” and an average price target of $58.77. This optimism reflects confidence in the company’s ability to deliver strong earnings and revenue growth in the coming years. The table below summarizes recent analyst ratings and price targets for On Holding:

| Analyst | Rating | Price Target | Date |

|---|---|---|---|

| KeyCorp | Overweight | $60.00 | April 29 |

| Needham & Company LLC | Buy | $50.00 | April 1 |

| Barclays | Overweight | $64.00 | March 5 |

| HSBC Global Research | Strong-Buy | N/A | March 11 |

| Morgan Stanley | Overweight | $66.00 | March 5 |

| Average Rating | Buy | $58.77 | N/A |

Earnings estimates further support this positive outlook. For example, Centerspace raised its Q2 2025 earnings estimate to $1.23 per share, while The Trade Desk expects revenue of $575.28 million and earnings of $0.25 per share. These projections highlight the potential upside for investors who choose to invest in On Holding.

As you evaluate On Holding’s stock, consider the analysts’ consensus and earnings report trends. These insights provide valuable context for understanding the stock’s future direction and potential future price performance.

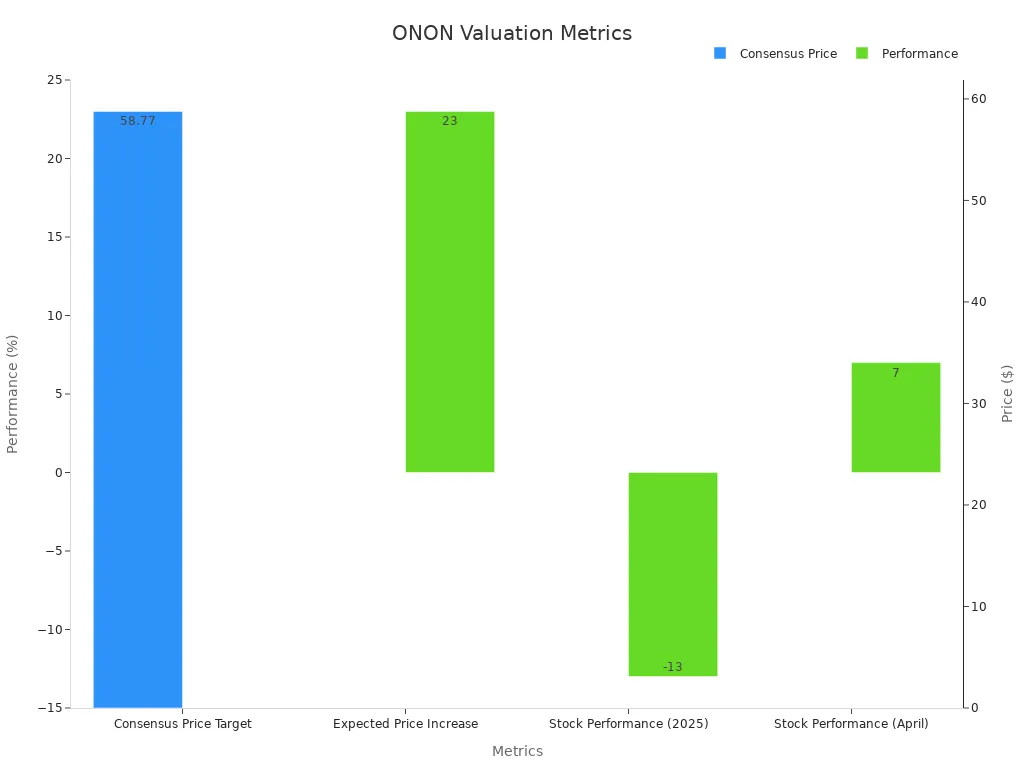

Valuation Metrics and Expert Ratings

Current Valuation Metrics

Understanding the current valuation of on holding stock is essential for assessing its market position. Analysts often rely on key metrics to determine whether a stock is overvalued or undervalued. For ONON, the consensus price target stands at $58.77, reflecting an expected price increase of 23%. However, recent stock performance shows mixed results, with a 7% gain in April but a projected decline of 13% in 2025.

| Metric | Value |

|---|---|

| Consensus Price Target | $58.77 |

| Expected Price Increase | 23% |

| Stock Performance (2025) | -13% |

| Stock Performance (April) | +7% |

Valuation also involves comparing price-to-earnings (P/E) and price-to-book (P/B) ratios with industry peers. These methods help you determine if ONON stock offers a competitive investment opportunity. Additionally, financial forecasting and leverage analysis provide insights into the company’s stability and growth potential.

Analyst Price Targets for ONON Stock

Analysts have shown optimism regarding ONON’s future performance. Needham recently raised its price target from $50.00 to $55.00, indicating a 10% increase. The average price target among 26 analysts is $60.29, with estimates ranging from $49.80 to $84.81. This broad range reflects varying expectations based on market trends and earnings potential.

- Needham increased its target to $55.00, reflecting a 10% rise.

- The average target price is $60.29, with a high of $84.81 and a low of $49.80.

- The average brokerage recommendation is 1.8, suggesting an “Outperform” status.

These targets highlight the confidence analysts have in ONON’s ability to deliver strong earnings growth. However, you should consider the potential risks associated with market volatility and changing consumer preferences.

Buy, Hold, or Sell Ratings

The consensus among analysts leans toward a “Buy” rating for ONON stock. This recommendation stems from the company’s robust earnings growth and favorable price targets. With a projected EBITDA of $509.8 million in 2025, ONON demonstrates strong operational efficiency. Analysts believe the stock has significant upside potential, making it an attractive option for long-term investors.

However, some caution is warranted. The projected 13% decline in stock performance for 2025 suggests that external factors, such as macroeconomic conditions, could impact earnings. As an investor, you should weigh these risks against the potential rewards before making a decision.

Comparing ONON Stock to Industry Peers

Image Source: pexels

Competitor Performance Metrics

When evaluating On Holding against its industry peers, comparing key performance metrics provides valuable insights. The table below highlights how On Holding stacks up against Lululemon Athletica, a prominent competitor in the premium athletic apparel and footwear market:

| Metric | ONON | Lululemon Athletica |

|---|---|---|

| Gross Revenue | $2.32B | $10.59B |

| Price/Sales Ratio | 13.50 | 3.23 |

| Net Income | $88.67M | $1.55B |

| Earnings Per Share | $0.83 | $14.70 |

| Price/Earnings Ratio | 59.89 | 19.29 |

| Net Margins | 5.87% | 17.05% |

| Return on Equity | 10.69% | 42.16% |

| Return on Assets | 6.66% | 25.02% |

| Market Cap | $31.30B | N/A |

| 1 Year Performance | 50.73% | N/A |

While On Holding demonstrates impressive revenue growth and market capitalization, its profitability metrics, such as net margins and return on equity, lag behind Lululemon. This disparity underscores the need for On Holding to enhance operational efficiency and cost management to remain competitive.

Market Position and Competitive Advantages

On Holding has carved out a unique position in the athletic footwear market by focusing on innovation and premium branding. Positioning gap analysis reveals that the company excels in meeting consumer expectations for high-performance, stylish footwear. Direct feedback from customers highlights On Holding’s strengths in product design and comfort, setting it apart from competitors.

This strategic positioning enables On Holding to identify and address market gaps effectively. By transforming customer insights into actionable strategies, the company continues to refine its offerings and strengthen its market presence. These competitive advantages position On Holding as a leader in the premium athletic footwear segment.

Sector Trends Impacting ONON

The athletic footwear industry is experiencing several transformative trends that could impact On Holding’s growth trajectory. Sustainability has become a key focus, with consumers demanding eco-friendly materials and production processes. On Holding’s commitment to innovation aligns well with this trend, offering an opportunity to capture environmentally conscious consumers.

Additionally, the rise of direct-to-consumer (DTC) sales channels is reshaping the retail landscape. On Holding’s investment in e-commerce and digital marketing positions it to capitalize on this shift. However, the company must also navigate challenges such as supply chain disruptions and fluctuating raw material costs, which could affect profitability.

By staying attuned to these sector trends, On Holding can adapt its strategies to maintain its competitive edge and drive long-term growth.

Risks and Opportunities for On Holding AG

Potential Risks to Growth in 2025

As you evaluate On Holding’s growth prospects, it’s essential to consider potential risks that could hinder its performance in 2025. Supply chain disruptions remain a significant concern. Delays in raw material procurement or production bottlenecks could impact the company’s ability to meet consumer demand. Additionally, rising inflation may increase operational costs, potentially squeezing profit margins and affecting net income.

Market volatility also poses a challenge. Fluctuations in consumer spending, driven by economic uncertainty, could reduce demand for premium athletic footwear. Companies that fail to integrate real-time data monitoring into their risk frameworks often experience more frequent disruptions. Predictive modeling can help assign probabilities to these risks, enabling On Holding to calculate potential losses and mitigate impacts. Historical data also plays a crucial role in forecasting future outcomes, helping the company identify and address vulnerabilities proactively.

Opportunities for Expansion

Despite these risks, On Holding has several opportunities to strengthen its market position. The growing demand for sustainable products presents a chance to innovate. By investing in eco-friendly materials and production methods, the company can attract environmentally conscious consumers. Expanding its direct-to-consumer (DTC) channels also offers significant potential. A robust e-commerce strategy allows On Holding to reach a broader audience while reducing reliance on traditional retail.

Geographic expansion remains another avenue for growth. Emerging markets in Asia and South America are experiencing increased interest in premium athletic footwear. By tailoring its marketing strategies to these regions, On Holding can tap into new revenue streams. Additionally, partnerships with influencers and athletes can enhance brand visibility, further solidifying its competitive edge.

Macroeconomic Factors Influencing ONON Stock

Macroeconomic conditions will play a pivotal role in shaping On Holding’s future. A strong U.S. dollar could impact international sales, making products more expensive for overseas consumers. Conversely, a weakening dollar might boost exports but increase the cost of imported materials. Interest rate fluctuations could also affect the company’s borrowing costs, influencing its ability to fund expansion initiatives.

Consumer confidence and spending trends will directly impact On Holding’s revenue. During economic downturns, discretionary spending often declines, which could affect demand for premium products. However, the company’s focus on innovation and brand loyalty may help mitigate these effects. Staying agile and responsive to macroeconomic shifts will be critical for maintaining growth momentum.

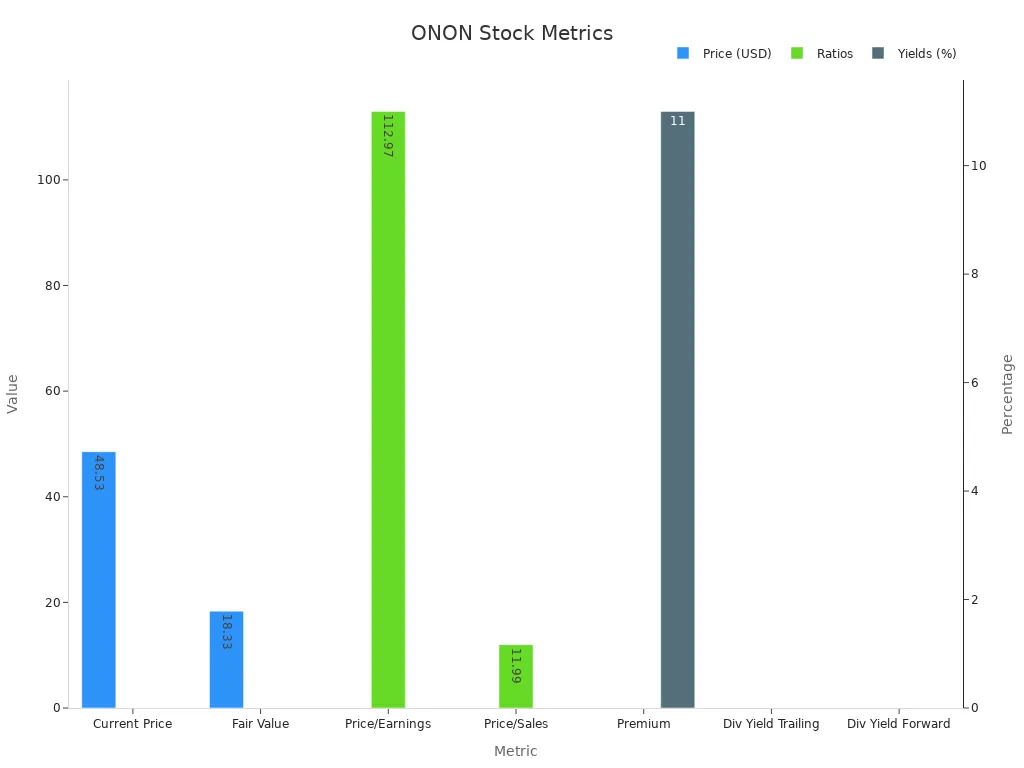

On Holding AG’s financial performance and forecasts for 2025 present a mixed picture. The company has shown impressive revenue growth, with projections reaching $2,962 million in 2025. However, its valuation metrics, such as a price-to-earnings ratio of 112.97 and a price-to-sales ratio of 11.99, suggest the stock trades at a premium. The absence of dividends further emphasizes its focus on reinvestment rather than shareholder returns.

| Metric | Value |

|---|---|

| Current Price | $48.53 |

| Fair Value | $18.33 |

| Premium | 11% |

| Price/Earnings Ratio | 112.97 |

| Price/Sales Ratio | 11.99 |

| Dividend Yield (Trailing) | 0.00% |

| Dividend Yield (Forward) | 0.00% |

When compared to peers, ONON stock demonstrates strong growth potential but lags in profitability metrics like net margins and return on equity. Analysts remain optimistic, with an average analyst rating of “Buy” and a consensus price target of $58.77. This reflects confidence in the company’s ability to deliver results despite potential risks like supply chain disruptions and inflation.

For investors, ONON stock offers an opportunity to capitalize on its growth trajectory. You should consider its premium valuation and the absence of dividends when making decisions. Diversifying your portfolio and monitoring macroeconomic trends can help mitigate risks while maximizing returns.

FAQ

1. What makes On Holding AG a unique investment opportunity?

On Holding AG stands out due to its innovative product designs and strong brand positioning in the premium athletic footwear market. Its consistent revenue growth and focus on sustainability align with evolving consumer preferences, making it an attractive option for long-term investors.

2. How do analysts view ONON stock for 2025?

Analysts maintain a positive outlook, with a consensus “Buy” rating and an average price target of $58.77. This reflects confidence in the company’s ability to deliver strong earnings growth despite potential risks like inflation and supply chain disruptions.

3. What risks should you consider before investing in ONON stock?

Supply chain disruptions, rising inflation, and market volatility could impact On Holding’s profitability. Monitoring these risks and macroeconomic trends will help you make informed decisions and mitigate potential losses.

4. How does ONON compare to competitors like Lululemon?

On Holding excels in revenue growth and market capitalization but lags in profitability metrics like net margins and return on equity. Its focus on innovation and premium branding gives it a competitive edge in the athletic footwear segment.

5. Does ONON stock pay dividends?

No, On Holding AG does not pay dividends. The company reinvests its earnings into growth initiatives, prioritizing expansion and innovation over shareholder returns.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Related Blogs of

Micro Dow, Micro Nasdaq, Micro S&P Futures Comprehensive Comparison – Helping You Find the Best Trading Choice

A Blessing for Small Investors: Finding the Lowest Trading Cost US Stock Brokers

Essential Apps for Getting Started with US Stock Futures: These Apps Will Turn You into a Pro

US Stock Market Holiday Countdown: How Investors Should Position for Next Week's Trading

Choose Country or Region to Read Local Blog

Contact Us

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.